AAIS COMMERCIAL LIABILITY COVERAGE FORM ANALYSIS

(December 2018)

|

|

INTRODUCTION

The American Association of Insurance

Services (AAIS) GL-200–Commercial Liability Coverage provides coverage

against claims for bodily injury, property damage, personal injury and

advertising injury that is caused by or results from the premises or operations

exposures of the named insured's business. Coverage also applies for claims for

bodily injury and property damage caused by or resulting from the products and

completed work exposures presented by the named insured's business. The

coverages provided apply on an occurrence basis.

The copyright of GL-200 is 1994. To

remain current, over the years AAIS has added several mandatory endorsements

for use with this form. To assist in understanding how the mandatory

endorsements change coverage, we have editorially pasted the changes into this

analysis.

The endorsements that are being

editorially pasted into the form are:

- CL-300–Amendatory

Endorsement

- GL 0163–Exclusion

– War and Military Action

- GL-890–Lead

Liability Exclusion

- GL 0950–Known

Injury or Damage Amendments

- GL 1020–Other

Insurance Amendment

- GL

1022–Information Distribution and Recording Violations Exclusion

- GL 1353–Exclusion

– Data Breach Liability

Related Article: AAIS Commercial Liability Coverage Available Endorsements and Their Uses

COVERAGE FORM INTRODUCTION

A table of contents

is provided as an aid when exploring the coverage form.

Certain words or phrases have special meanings. They

are listed in the Definitions section, which follows the insuring agreement, and

are shown in bold type or in quotation

marks throughout the coverage form.

Editorial note: The bolded words above were added by

CL-300–Amendatory Endorsement.

INSURING AGREEMENT

The insurance

company agrees to provide the commercial liability coverage described in the

policy. However, the coverage is provided subject to terms and conditions of

the policy being met. All contracts require consideration be provided and, in

an insurance contract, the consideration is the insured’s payment of the

required premium.

The policy terms related

to cancellation, changes made to the policy, examination of books and records,

surveys and inspections, and assignment or transfer of rights or duties also

apply even though they are not contained in this coverage part. These are

mentioned separately because they are not part of this coverage form. They are

found in CL 0100–Common Policy Conditions which must be attached to every

commercial lines policy.

Related Article: CL 0100–Common Policy Conditions Analysis

DEFINITIONS

When any of the following

terms are used in the policy, the explanation in this section applies rather

than the dictionary definition of the term.

1. You and your

The entity named as the insured on the declarations. There can be more

than one you or your.

2. We, us and

our

The insurance company providing the insurance coverage in this form.

3. Advertising injury

An injury that arises from any or all the following offenses:

- Slander or libel against a person or

organization that occurs verbally or in a written publication

- Verbal or written communication that degrades

the goods, products or services of another

- The violation of a person's right of

privacy in written or verbal communication

- The theft of or use of, without

permission, other’s advertising ideas or the style in which that other does

business

- The infringing upon a copyright, title,

slogan, trademark or trade name

An advertising injury does not involve bodily injury, property damage or

personal injury.

4. Auto

A vehicle that is designed to be used on a public road. The vehicle can

be motorized, or it may be a trailer or a semi-trailer, but it must be

land-based. All machinery and equipment that is attached to the vehicle is also

considered auto.

5. Basic territory

This territory is the United States of America, its territories and

possessions, Canada and Puerto Rico.

6. Bodily injury

Bodily harm, sickness or disease of a person. The required care of the

person and loss of services that person normally provided is also bodily injury.

Death that results from the initial bodily harm, sickness or disease is bodily

injury regardless of when that death occurs. Mental or emotional injury,

suffering or distress is bodily injury only when it results from a physical

injury.

|

Example: Geraldine slips on a lettuce leaf at My Favorite Buffet restaurant.

Her leg sustains a compound fracture. Her family witnessed the bone pierce

the flesh during the fall. All services provided to Geraldine to care for

that injury are considered bodily injury. Geraldine works full time and then

cares for her mother and sister in the evenings. The cost to replace these

services is also bodily injury. An infection settles into Geraldine’s leg and

after three years of treatment, Geraldine dies. Her death, even though three

years after the injury, is bodily injury. Maggie, Geraldine’s sister,

witnessed the injury and has been receiving psychiatric treatment for the

trauma since the accident. This is not bodily injury because Maggie did not

sustain a physical injury. |

|

7. Coverage territory

All the following are considered the coverage territory:

- The basic territory as defined above

- Bodily injury, property damage,

personal injury or advertising injury that occurs in international waters

or airspace during travel that starts in or ends in the basic territory

- The world. However, while the expansion

of territory is broad the coverage it applies to is narrow. 1) Any payment

obligations for liability must be determined in the basic territory or

through a settlement the insurance company had agreed upon. Otherwise,

there is no worldwide coverage.

2) If 1) is satisfied then liability for products made or sold in the

basic territory is covered wherever in the world the occurrence happens.

3) If 1) is satisfied then the activities a person who is out of the

basic territory for only a short term while on the named insured’s business are

covered.

|

Example: Marilyn’s Must Haves sells women’s accessories through various retail

outlets and the web. Scenario 1:

Hector, an employee, travels from his home in Arizona to Paris to meet with a

retail client. In Paris, Hector places his bag on the floor of a café and a

woman trips over the bag and breaks her leg. If a suit is brought in the

basic territory for this injury, this policy will respond. If the suit is

brought in Paris, this coverage will not respond. Scenario 2:

Gretel purchases Marilyn’s product and is injured by it. She sues Marilyn for

the injury. Gretel purchased the product over the internet but lives in

Germany. If the suit is brought in the basic territory this insurance

coverage will respond. If not, no coverage applies. |

8. Damages

Money that is provided to a person as compensation for an injury.

Data Records (No number assigned)

(Editorially added wording from GL 0950–Known Injury or Damage

Amendments)

Stored documents, files and other information while in an electronic

format. The storage must be on some sort of instrument that is used with any

type of computer hardware, network, program or application. Electronically

controlled equipment is considered as a type of computer hardware, network

program or application.

9. Declarations

A broad term meaning the actual declarations, supplemental declarations and

schedules relating to this policy.

Designated Insured (No number assigned)

(Editorially added wording from GL 0950–Known Injury or Damage

Amendments)

There are five types of entities that can be considered designated

insureds.

The first four designated

insureds are based on the type of business entity entered on the Declarations

and is similar to the definition of insured found later in the policy:

- Individual: The individual and his or her spouse are designated

insureds. However, they are so designated only with respect to the conduct

of the business for which the named insured is the sole owner.

- Partnership or Joint Venture: The named insured, its partners,

members and their spouses are designated insureds. However, they are so

designated only with respect to the conduct of the named insured’s

business.

- Limited Liability Company: The named insured, its members and its

managers are designated insureds. However, each is so designated only

within the scope of their particular duties.

- Organization That Is Not a Partnership, Joint Venture or LLC: The

named insured and all its executive officers and directors are designated

insureds. However, each is so designated only within the scope of their

particular duties. The named insured’s stockholders are also so designated

but only for their liabilities as stockholders.

- Any employee that is defined below and has been authorized to

either provide or to receive an occurrence or claim notice.

Note: There is no indication as to who must provide the authorization to

the employee.

10. Employee

This is not a definition but is instead an expansion of the term. The

word employee expands to include leased workers. The term is not expanded to include

temporary workers though.

11. Impaired property

Property must meet all four of the following to be considered impaired

property:

- The property is tangible

- The property is neither the named insured’s product nor the named

insured’s work

- The property’s value is decreased

because it has become dangerous or deficient either due to its including the

named insured’s products or work or because the named insured failed to

fulfill its contract terms

- Its value can be restored either by repairing,

replacing, adjusting or removing the named insured’s products or work or

by the named insured fulfilling its contract terms.

Related Court Case: Commercial General Liability No Coverage for

Damages from Insured's Inferior Lumber

12. Insured

The first group of defined insureds is based on the type of business

entity entered on the Declarations:

- Individual: The individual and his or

her spouse are insureds. However, they are insureds only with respect to

the conduct of the business for which the named insured is the sole owner.

- Partnership or Joint Venture: The named

insured, its partners, members and their spouses are insureds. However,

they are insureds only with respect to the conduct of the named insured’s

business.

- Organization That Is Not a Partnership

or Joint Venture: The named insured and all its executive officers and

directors are insureds. However, each is an insured only within the scope

of their duties for the organization. The named insured’s stockholders are

also insureds but only for their liabilities as stockholders.

The next group qualifies as insureds, regardless the type of business

entity:

- The named insured's real estate

manager. This can be a person or organization but if a person, he or she cannot

be an employee of the named insured.

- If the named insured is an individual

and dies the business may continue, so others become insureds. The named

insured’s legal representative is an insured but only while acting within

the scope of duties as such.

Any person having custody of the named insured’s property at the time of

the named insured’s death is an insured but only with respect to liability

arising out of the maintenance or use of that property and that person stops

being an insured as soon as the legal representative is appointed.

The legal representative takes on all the named insured's rights and

duties under this coverage.

- The following are insureds when using

the named insured’s mobile equipment but only if the use is with its

permission:

- An employee of the named insured while

using the equipment during the course of employment. If a fellow employee

is injured, the employee that caused the injury is NOT an insured.

- Non-employees but only if they have no

insurance coverage and the liability is due to the operation of the

equipment. Organizations or persons legally liable for that non-employee’s

conduct are also insureds. They are not insureds for any damage they

cause to their employer’s owned or rented property, to property that

employer is occupying or to property for which their employer is

responsible.

- Insured status based on mobile

equipment use described above does not apply for any loss that involves

damage to the named insured’s owned or rented property, to property the

named insured is occupying or to property for which it is responsible.

- The named insured’s employees. This is

limited to only for acts that are performed within the scope of their

employment. It is further restricted with employees not being insureds for

bodily injury, personal injury or advertising injury to either the named

insured or a fellow employee. Also, they are not insured for property damage

to property owned by, rented to or loaned to employees or to partners,

members or the partners or members spouses. Executive officers are not

considered employees in this section.

- Any newly acquired or formed

organization of the named insured. This applies only when the named

insured has a majority interest in it. Newly formed or acquired joint

ventures or partnerships are not insureds.

The newly acquired or formed organization is

not an insured for any of the following:

- When it carries or has in some way

other comparable coverage available to it

- After the policy period in which it

was formed or acquired ends or 90 days after its formation or

acquisition, whichever comes first

- For any bodily injury or property

damage occurring before the date of acquisition or formation

- For any personal injury or advertising

injury offense committed before the date of acquisition or formation.

Unless a partnership or joint venture is listed as a named insured on

the declarations no person or organization is an insured in relation to the

partnership or joint venture’s conduct either past or present.

13. Leased worker

A worker who is leased by the named insured from a labor leasing entity using

a contract or an agreement. The contract must provide for the person to perform

duties relating to the conduct of the named insured's business. Temporary

workers are not considered leased workers.

14. Limit

The amount of coverage being provided by this policy.

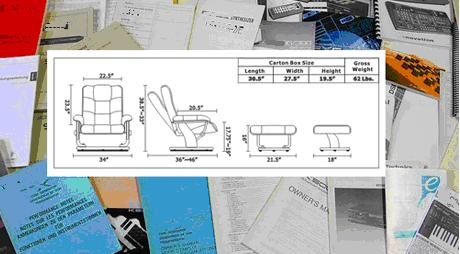

15. Loading or unloading

The movement of property that begins with the property’s removal from

the point where it is accepted for transit by a vehicle. Loading or unloading

continues while it is in or on the vehicle and ends when the property is removed

from the vehicle at the destination. The movement by any mechanical device

attached to the vehicle and movement by a hand truck is considered loading and

unloading but movement by any other type of mechanical device is not loading or

unloading.

|

Example: Step 1: Millie

moves the television from its storage location and moves it to the loading

dock. Step 2: Jason

picks up the television with the intention of placing it in his box truck. Step 3: Jason

places the television in the truck Step 4: Jason

drives his truck to his customer Step 5: Jason

removes the television from his truck and places it on the customer’s loading

dock. Step 6: Frank

moves the television from the loading dock and into another part of the

building. Steps 2, 3, 4 and

5 are considered loading and unloading. |

16. Occurrence

An accident. It is not limited to a single event but includes repeated

exposure to conditions that are the same or similar.

17. Personal injury

An injury that is not bodily injury, property damage and advertising. It

must arise from any or all the following offenses:

- Slander or libel against a person or

organization that is expressed verbally or in a written publication

- Providing verbal or written

communication that speaks poorly of or in a degrading manner about the

goods, products or services of another.

- The violation of a person's right of

privacy that is expressed either verbally or in written communication

- Arrest, detention or imprisonment for

false reasons

|

Example: Millie asks a customer to remain in the store. The customer refuses

so Millie grasps her arm and walks her to the back of the store. She is

convinced the customer was shoplifting. Millie calls the police. The customer,

after proving that no store item was taken, is released. Later the customer

sues the store for false arrest and detention. |

|

- Prosecution with malice

- Tenant-related offenses committed by or

on behalf of the owner, landlord or lessor of a room, dwelling or

premises. The offenses are wrongful entry in or eviction from, or invasion

of the right of private occupancy of a room, dwelling or premises.

|

Example: Paul, the property manager at Golden Acres, regularly uses his master

key to enter tenants’ apartments while they are away. Pauline sues Golden

Acres and Paul for invasion of privacy when she discovers Paul in her

apartment. |

18. Products/completed work hazard:

- The product hazard is bodily injury or

property damage that meets two requirements. The damage or injury must occur

away from locations owned or rented by the insured and it must arise out

of products which have been physically released or handed over to others.

- The completed work hazard is bodily

injury or property damage that meets two requirements. The damage or

injury must occur away from locations owned or rented by the named insured

and must arise from the named insured’s work.

The named insured’s work does not include work that is still in process

or that has been abandoned. Work is defined as completed on the earliest date

of the following:

- When all contract work for which the named

insured is responsible is completed

- When multiple jobs are part of a

single contract, the work at a specific jobsite is complete when named

insured’s work at that jobsite is done

- When the named insured's work at a job

site is put to its intended use by any person or organization. The only

exception is when a subcontractor or contractor working the same job and

site are the ones using the work.

Work is deemed completed even if it needs further service, maintenance,

correction, repair or replacement because of a defect or deficiency.

- The products hazard and the completed

work hazard do not include bodily injury or property damage that arises from

any of the following:

- Transportation of property. However,

when injury or damage is due to a condition in or on the vehicle which

was created by loading or unloading there is coverage.

|

Example: Glen tied down the property in the back of the box truck to prevent

it from moving. The tie down was not secure, and the property broke loose.

The damage caused by the loose property is considered products hazard because

it occurred during the loading of the box. |

|

- Tools, uninstalled equipment or

abandoned or unused materials being present

- Any products or work when a classification

is shown on the declarations to include Products/Completed Work.

Note: This product and work would be covered as

premises type losses not products/completed work and a part of the General

Aggregate, not the products/completed work Aggregate.

|

|

Example: Kelly’s Consulting designed and produced small, liquid center,

paperweights for a promotional event. One of the paperweights leaked and

damaged a customer’s mahogany desk. The property damage claim is considered

premises coverage because the Consulting classification included Products/completed

operations within the premises code. |

19. Products

Goods or merchandise that the named insured manufactures, sells,

handles, disposes of or distributes. This term also refers to such goods and

merchandise of others that trade using the named insured's name to manufacture,

sell, handle, dispose of or distribute. Such goods and merchandise of persons

or organizations acquired by the named insured to manufacture, sell, handle,

dispose of or distribute are also products.

Real property is never considered products. Vending machines or other

property that is rented to or placed for the use of others, but not sold to

them are also not products.

Products are also all the following:

- Fitness, quality, durability or

performance warranties or representations of the products whenever those

warranties or representations are made

- Containers, materials, parts or

equipment furnished with the products. Vehicles are not considered

containers.

- Instructions and warnings that are

provided or should have been provided.

|

Example: Peter sells ready-to-assemble furniture. The furniture is considered

products. The instruction book on how to assemble the furniture is also

product. The warnings that accompany the furniture is also considered

product. The box in which the ready-to-be-assembled furniture is shipped is

also considered product. |

|

20. Property damage

Physical injury to or destruction of tangible property. The term is also

the loss of use of tangible property. The tangible property is not required to

be damaged for there to be loss of use property damage. Loss of use is simultaneous

with the occurrence that caused it.

|

|

Example: Piper Broadcasting’s antenna fell onto the sidewalk of Peggy’s Fine

Furniture, blocking its entrance. Customers are unable to enter Peggy’s store

for two days as Piper worked with contractors to have it moved. Peggy’s two-day

loss of use is considered property damage even though Piper’s antenna did not

physically damage Peggy’s furniture or store. |

21. Temporary worker

A temporary substitute for a regular

employee who is a natural person and is furnished to the named insured.

22. Terms

Any and all provisions, limitations, exclusions, conditions and

definitions that apply to this coverage.

23. Your work

Any or all of the following:

- Work or operations that are either done

by the named insured or on its behalf

- Materials, parts or equipment that are provided

for the work or operations

- Quality, fitness, durability or

performance warranties or representations. These must pertain to the work

or operations, must be in writing and can be made at any time.

|

Example: Peter is really disgusted. In October he hired Justin’s Fire Safety

to prepare the extinguishing system for winter. Justin told Peter that the

system would be able to withstand cold to -30 degrees. Temperatures drop but

at no time do they go below –15 degrees. When temperatures return to above

freezing the sprinkler system begins to leak. Peter sues Justin’s for the

damage caused by the leaking. Justin’s insurance company denies the claim

because the warranty was verbal – not written. |

- Instructions and warnings that are

provided or should have been provided

PRINCIPAL COVERAGES

The insurance

company provides insurance coverage on the following but only when a specific

limit or premium charge is shown for it on the declarations.

Coverage L–Bodily Injury Liability and Property Damage Liability

The sums an insured is legally obligated to pay as damages due to bodily

injury and property damage covered by this insurance will be paid by the

insurance carrier. The injury or damage must be caused by an occurrence. The

occurrence must take place in the coverage territory. The bodily injury or

property damage must happen during the policy period.

(Editorially

added wording from GL 0950–Known Injury or Damage Amendments)

Insurance for

Coverage L is only available to:

Bodily injury or property damage that is separate and distinct from

bodily injury or property damage of which a designated insured was aware before

this policy’s effective date. This means that the current bodily injury or

property damage cannot be a resumption, change or continuation of that prior

bodily injury or property damage.

It is important to realize that continuation, resumption, and change in

such prior bodily injury or property damage is considered to be known in that

prior policy period.

|

Example: Paula falls at Porgy’s Place. She had a

head injury and made it home before collapsing. She never came out of the

coma. One year later she dies of those injuries. Scenario 1: Paula’s estate traced

her actions prior to her accident and discovered that Paula fell at Porgy’s.

The family hired an investigator and was able to present a claim against

Porgy’s Place. This is covered under the current policy because the injury

had never been known by anyone at Porgy’s. Scenario 2: Justin, a partner at

Porgy’s, witnessed the fall. He was concerned and asked Paula if she wanted

an ambulance. She declined but asked for a cab. Justin is a designated

insured so because he had knowledge of the bodily injury, the current policy

does not respond but the prior one might. |

Bodily injury or property damage that is separate and distinct from

bodily injury or property damage of which a designated insured was aware before

this policy’s effective date. This means that the current bodily injury or

property damage cannot be a resumption, change or continuation of that prior

bodily injury or property damage.

Any resumption, change or continuation of a bodily injury or property

that is first known in the current policy period is covered under the current

policy.

|

Example: Mavis runs her golf mobile into her neighbor’s carport. The damage

appears minor and her insurance carrier pays for the cosmetic improvements.

Six months later heavy snow on the carport causes it to collapse. An

investigation by the neighbor’s insurance adjuster reveals that Mavis’s

accident had weakened the support beam which contributed to the collapse.

Mavis’s policy that paid for the cosmetic improvement will also respond to

the carport collapse claim even though it happened in a different policy

term. |

Coverage M–Medical Payments

Certain medical expenses

are paid when bodily injury results from an accident. These are paid without

regard to negligence. The accident must happen on the named insured’s owned or

rented premises or on ways (streets, alleys, sidewalks) that are adjacent or

next to the named insured’s owned or rented premises. Medical expenses that

occur off premises but arise from the named insured's operations are also

covered.

The accident from

which the expenses arise must occur during the policy period and in the

coverage territory. The only expenses paid are those that are both incurred and

reported to the insurance company within one year of the date of the accident.

Medical expenses must

be both reasonable and necessary. The specified expenses that will be paid are medical,

surgical, x-ray and dental services, including prosthetic devices and

eyeglasses. In addition, the cost of ambulance, hospital, professional nursing

and funeral services are paid. A particularly important covered expense is the first

aid rendered at the time of the accident.

|

Example: Marcy

is jogging past a new construction site. Milton, an employee of Brickmasters,

Inc., is working on a building wall. Milton loses his grip, dropping a heavy

trowel that knocks Marcy down. Milton immediately calls 911 and insists that

Marcy be transported to a hospital. All of the medical expenses associated

with the 911 transport and the hospital stay are covered by Brickmasters,

Inc.’s coverage, subject to the medical payments limit of insurance. |

|

Coverage N–Products/Completed Work

The sums which an

insured is legally obligated to pay as damages due to bodily injury and

property damage arising out of the products/completed work hazard covered by

this insurance will be paid by the insurance carrier. The injury or damage must

be caused by an occurrence. The occurrence must take place in the coverage

territory. The bodily injury or property damage must happen during the policy

period.

|

Example: Jelly Spot makes candy that is sold worldwide. On 8/1/2018, while in

Paris, Kelly bites into a Jelly Spot and breaks a tooth as he encounters a

piece of metal in the Jelly Spot. Kelly sues Jelly Spot. An investigation

reveals that an incident occurred at the Jelly Spot Pennsylvania location on

10/1/2017 that caused metal to enter some candy. The plant thought they had

caught all the problem boxes, but this one made it through. The policy in

effect on 8/1/2018 would cover this loss because the policy in effect at the

time of the bodily injury is the one that applies – not the one as of the

date of the occurrence. |

|

(Editorially

added wording from GL 0950–Known Injury or Damage Amendments)

Insurance for

Coverage N is only available to:

Bodily injury or property damage that is separate and distinct from

bodily injury or property damage of which a designated insured was aware before

this policy’s effective date. This means that the current bodily injury or

property damage cannot be a resumption, change or continuation of that prior

bodily injury or property damage.

It is important to realize that continuation, resumption, and change in

such prior bodily injury or property damage is considered to

be known in that prior policy period.

Bodily injury or property damage that is separate and distinct from

bodily injury or property damage of which a designated insured was aware before

this policy’s effective date. This means that the current bodily injury or

property damage cannot be a resumption, change or continuation of that prior

bodily injury or property damage.

Any resumption, change or continuation of a bodily injury or property

that is first known in the current policy period is covered under the current

policy.

Coverage O–Fire Legal Liability

The sums that the named insured is legally liable for property damage by fire it caused to buildings, or parts of buildings rented or loaned to the named insured is paid by the insurance carrier. Buildings include any permanently attached fixtures.

None of the property damage exclusions apply to this coverage.

In an unusual type of policy construction, the exclusions that apply to this coverage are stated within the coverage description.

Coverage O- Fire Legal Liability Exclusions

The following are not covered:

- Liability when it is due to any contract or agreement in which the insured agrees to indemnify any person or organization for damage by fire to the premises.

Note: A misunderstanding could arise if the insured signed such a contract and a loss occurred. If the only reason for the obligation is the contract, the exclusion would apply. However, if the insured is legally liable in addition to the contractual obligation the exclusion should not apply.

- Liability when the insured expected, directed or intended the property damage.

- Liability when the property damage was the result of acts of the insured that were both intentional and malicious.

Coverage P–Personal Injury Liability and Advertising Injury Liability

The sums which an

insured is legally obligated to pay as damages because of personal injury or

advertising injury that is covered by this insurance, the insurance carrier

will pay.

Personal injury is

covered when an offense is committed in the course of the named insured’s

business. However, advertising, publishing, broadcasting or telecasting offenses

committed by or on behalf of the named insured are not covered.

Advertising injury

is covered when an offense is committed when the named insured’s goods, products

or services are being advertised.

Related Court Case:

Advertising Injury Coverage Held Applicable To Misappropriation of

Product Style Promoted In Ads

An offense must be

committed during the policy period and in the coverage territory.

SUPPLEMENTAL COVERAGES

The insurance

company provides three supplemental coverages. They are subject to all terms of

the Principal Coverages. These do not increase the limits for the Principal

Coverages.

Contractual Liability

Bodily injury and

property damage liability assumed under the following contracts or agreements is

covered:

- Premises leases

- Agreements for easements or licenses. Agreements

related to construction or demolition operations within 50 feet of a

railroad are not covered.

- Municipal indemnification agreements

but only when required by ordinance. Agreements that are made in

conjunction with work done for the municipality are not covered.

- Sidetrack agreements. These are

agreements between a party with a sidetrack on its premises and the

railroad providing the track.

- Agreements for the maintenance of

elevators

- Any assumption of tort liability for

damages due to bodily injury or property damage that is part of a contract

or agreement related to the named insured’s business. (Indemnification

agreements with a municipality in conjunction with work done for that

municipality is included.)

Tort liability is defined in this item to be liability that is imposed

by law when there is no contract or agreement.

The insurance

provided by this supplemental coverage does not apply to any part of the

following types of contract or agreements:

- Indemnification of any person or

organization for bodily injury or property damage arising out of any

operations within 50 feet of any railroad property. This restriction applies

only when those operations have any type of effect on railroad bridges,

trestles, tracks, road-beds, tunnels, underpasses or crossings.

- Indemnification of an architect,

engineer or surveyor for injury or damage but only when it arises from any

of the following:

- The preparation, approval or failure

to prepare or approve maps, drawings, opinions, reports, surveys,

changes, orders, designs or specifications

- The providing of directions or

instructions, or failure to do so. This applies only when the providing

or failure to provide such directions or instructions is the primary

cause of the injury or damage.

- Assumption of liability for injury or

damage arising out of the rendering or failure to render any professional

services. This applies only when the insured is an architect, engineer or

surveyor. The excluded services include supervisory, inspection or

engineering services and the preparation, approval or failure to prepare

or approve maps, drawings, opinions, reports, surveys, changes, orders,

designs or specifications.

- Indemnification of any party for damage

by fire to the named insured’s rented or loaned premises.

Incidental Medical Malpractice Injury

Bodily injury that

is the result of the rendering or the failure to render the following

medical-related services is covered:

- Medical, surgical, dental, x-ray,

nursing services or treatment. When food or beverages is furnished in

conjunction with these treatments, bodily injury due to those items is

also covered.

- Drugs or medical, dental or surgical

supplies or appliances that are furnished or are dispensed.

|

Example: Jessica is shopping in Simply Chic when she begins to feel faint and

says she is about to pass out. Patty, a nursing student working part time at

Simply Chic, believes Jessica is diabetic so provides some orange juice.

Jessica is allergic to orange juice. This coverage will pay when Jessica sues

Simply Chic. |

|

The insurance

provided by this supplemental coverage does not apply to any of the following:

- First aid to others expenses incurred

by the insured at the time of an accident

- An insured or an employee whose

occupation or business is the providing of any of the services listed in

this supplement coverage

- Injury caused by an indemnitee when

that indemnitee’s occupation or business involves providing any of the

services listed in this supplemental coverage.

Mobile Equipment

Related Article:

CA 20 15-Mobile Equipment

Sums for which an insured

is legally liable to pay because of bodily injury or property damage that result

from mobile equipment or from any machinery and equipment attached to the

mobile equipment are paid by the insurance company.

To be eligible for

coverage the mobile equipment must be a land motor vehicle. In addition, it must

meet at least one of the following requirements:

- Used only at the named insured’s owned

or rented locations or their adjoining ways

- Designed for use primarily off public

roads

Note: It could be used on public roads. The key

is that it must be designed primarily for off road use.

- Travel on crawler treads

- Self-propelled and designed for the

sole purpose of providing mobility to power cranes, shovels, loaders,

diggers or drills; concrete mixers other than mix-in-transit; or graders,

scrapers, rollers and other road construction or road repair equipment.

The equipment must be a permanent part of the vehicle.

- Not self-propelled and used primarily

to provide mobility to air compressors, pumps and generators, including

spraying, welding and building cleaning equipment; geophysical

exploration, lighting and well servicing equipment; and equipment used to

raise or lower workers such as cherry pickers. The equipment must be

permanently installed on the vehicle.

The insurance

provided by this supplemental coverage does not apply to self-propelled

vehicles if any of the following machinery and equipment is permanently

attached:

- Snow removal, street cleaning and road

maintenance equipment, other than road construction or resurfacing

- *Equipment used to raise or lower

workers such as a cherry picker

- *Air compressors, pumps and generators,

including spraying, welding and building cleaning equipment

- *Geophysical exploration, lighting and

well servicing equipment.

*The insurance

company will cover any bodily injury or property damage arising from the

operation of any of this equipment but NOT for the operation of the vehicle.

The insurance company

also provides any liability, uninsured motorists, no-fault or other coverage

required by any motor vehicle insurance law, in addition to providing the

required limits for the coverage as prescribed by that law.

Note: The providing of uninsured motorist, no-fault or other mandatory

coverage could be expensive because nothing in this item provides a limit of

liability relating to those coverages. The insurance carrier may be thinking

state minimums while the insured is thinking about CGL occurrence limits.

DEFENSE COVERAGE

The payments under

this coverage are in addition to the limits for Commercial Liability Coverage.

The insurance

company has both the right and the duty to defend any suit seeking damages that

may be covered by this insurance. The insurance company has the right to make

any investigations and to settle any claims or suits.

Note: The decision on settlement rests solely with the insurance company.

The term suits is

expanded to include arbitration or other alternative dispute resolution

proceedings that involve bodily injury, property damage, personal injury or

advertising injury to which the named insured is required to submit or to which

the named insured is granted permission to submit by the insurance carrier.

After the limit of

insurance has been paid out due to a judgement or written settlement, this

defense coverage is no longer provided.

|

|

Example: Piedmont

Fireworks has Commercial Liability Coverage with a $1,000,000 General

Aggregate Limit. Fireworks on the premises explode causing property damage to

nearby buildings and bodily injuries to several pedestrians. Each injured

person and property owner files separate claims for their losses as a result

of the explosion. The insurance company begins to make settlements with the

injured persons. Once they pay out $1,000,000, the limit is exhausted, and

the insurance company has no further obligation to provide legal defense or

coverage for the remaining lawsuits. Piedmont must defend and pay all

remaining actions on its own. |

(Editorially

added wording from GL 0950–Known Injury or Damage Amendments)

There is no duty

to defend suits or claims for damages when the bodily injury or property damage

was known by a designated insured prior to the policy term.

When the insurance

company defends a suit, it pays the following:

- Costs that the courts tax to the

insured

- Expenses the insurance company incurs

- Up to $100 per day for the loss of

earnings the insured incurs because of time away from work. Payment is

made only if the insurance company requests that the insured takes the

time away.

- When the insurance company requests the

insured to incur expenses, it will pay for them. However, if the insured incurs

expenses without such a request, compensation should not be anticipated.

- The amount of pre-judgment interest

awarded against the insured but only on the portion of the judgment the

insurance company pays. Once the insurance company offers to pay the

policy limit, it is no longer responsibility for pre-judgment interest incurred

following that offer.

- Interest that accumulates following the

entry of a judgment and ending when the insurance company tenders,

deposits in the court or pays up to its coverage limit. This is not

limited to only the amount of the judgment for which the insurance company

is responsible.

- Costs of appeal bonds or bonds for the

release of attachments but only the cost of the amount of the bond up to

the coverage limit. The insurance company is not required to apply for or

furnish such bonds.

- Costs of bail bonds required of the

insured because of an accident or traffic violation due to the use of a

vehicle to which Coverage L–Bodily Injury/Property Damage applies. The

cost is limited to $500. The insurance company pays the cost only. The

insured is responsible for applying for and obtaining the bonds.

EXCLUSIONS

The insurance

company does not pay for a loss if one or more of the excluded events listed

below apply to it. This is regardless of other causes or events that contribute

to or aggravate the loss, whether such causes or events act to produce the loss

before, at the same time as, or after the excluded event.

Exclusions That Apply To Bodily Injury, Property Damage, Personal Injury and/or Advertising Injury

1. Contractual

Coverage does not apply for bodily injury, property damage, personal

injury or advertising injury liability that is assumed by the insured under a

contract or agreement. There are two exceptions. If the liability would have

existed without a contract being in place the coverage applies even though

there is a contract requiring it.

|

Example:

Preston Furs, LLC owns the building occupied by the retail fur shop and fur

storage facility. It leases the extra space in the building to Kevin’s Stamp

and Coin Shop. Kevin requires that the written lease of premises guarantee

that the premises are safe and meet all life or public safety regulations and

requirements. Because Preston Furs, LLC. holds this obligation, regardless

that it is ALSO contained in the lease, coverage applies. |

This exclusion also does not apply to bodily injury or property damage

covered under the Contractual Liability Supplemental Coverages. However, to be

covered, the injury or damage must occur after the effective date of the

covered contract or agreement.

2. Professional

There is no coverage for bodily injury, property damage, personal injury

or advertising injury arising out of the providing of or failure to provide any

professional service. There is some limited coverage provided under the Incidental

Medical Malpractice Injury Supplemental Coverage.

3. Racing

The insurance company does not pay for bodily injury, property damage,

personal injury or advertising injury that result from mobile equipment being

used in various racing, stunt or other types of contests. This exclusion

applies not only during the actual event but also during practice, preparation

and that event.

4. Mobile Equipment Transport

Coverage does not apply for bodily injury, property damage, personal

injury or advertising injury that are related to the transportation of mobile equipment

by an auto owned or operated by, or rented or loaned to, any insured.

|

Example: Merle

works for Juniper Construction. He uses one of Juniper’s trucks to haul a

trailer with a skid steer to a job site. The trailer hitch snaps, causing the

trailer to overturn and throw the skid steer into the path of several

vehicles. There is no coverage for Juniper Construction under this coverage

form for any of the property damage or bodily injury. However, the automobile

liability policy covering the towing vehicle should respond. |

|

5. Auto, Aircraft, Watercraft, Mobile Equipment

This is a wide-ranging endorsement. It excludes coverage for bodily injury, property damage, personal injury and advertising injury arising out of not only the ownership of auto, aircraft, watercraft or mobile equipment but also their operation, occupancy, renting, loaning, supervision, maintenance, use, entrusting, loading or unloading. The coverage for the auto, aircraft, watercraft or mobile equipment is excluded if owned or operated by, or rented or loaned to, any insured.

|

Example:

Michael and Michelle own a boat and loaned it to Peter and Jane. When the boat sinks and Jane is injured, Michael

and Michelle’s CGL policy does not provide coverage for Jane’s injuries. |

There are five exceptions in this

exclusion.

- There is coverage if bodily injury or

property damage arises out of autos or mobile equipment that are covered

under the Mobile Equipment Supplemental Coverage

|

Example: A

modified pickup truck with permanently installed well drilling equipment

accidentally strikes the side of a building while maneuvering into place over

a well and damages the building. The damage to the building is covered. |

- There

is coverage when non-owned autos are being parked at locations owned or controlled by, or rented to, the insured and

on ways immediately adjoining the location.

|

Example: Gerald

is announcing the opening of his newest location by hosting a large catered

party. He asks Janet and Max, two of his employees, to provide valet parking

for the guests. Janet places the car she is parking in reverse by mistake and

pins one of the guests between it and another car. Coverage applies in this

situation. |

- When

liability is assumed for the

ownership, maintenance or use of an aircraft or watercraft under a

contract covered under Contractual Liability Supplemental Coverages, there

is coverage.

|

Example: Pete

charters an emergency flight to meet an important client and the charter

company requires a hold-harmless agreement. |

- Watercraft while on shore at a location

owned or controlled by, or rented to, the named insured is covered.

|

Example: A

pontoon boat is stored on the insured's premises in the winter. The children

in the neighborhood think it is fun to slide off the ice-covered watercraft.

When one is seriously injured, and the insured is sued, there is coverage. |

|

- Watercraft not owned by the named

insured is covered if it is less than 26 feet long and is not used to

carry either persons or property for a fee.

|

|

Example: Power Dynamics rents a pontoon boat for an afternoon sales presentation and uses a small grill to cook appetizers. The grill causes a fire. When the guests move away from the fire, the boat shifts, and several the guests are thrown overboard into the water. Several are injured. Because the pontoon is less than 26 feet and is non-owned, coverage for the injuries applies. |

6. Liquor

This is an unusual exclusion because it only applies to a subset of

named insureds. If the named insured is in the business of manufacturing,

distributing, selling or servicing alcoholic beverages this exclusion applies.

All other businesses can ignore this exclusion.

The insurance company does not pay for bodily injury, property damage,

personal injury or advertising injury for which any insured may be held liable

by reason of any of the following:

- Causing or contributing to a person’s

intoxication

- Providing alcoholic beverages to persons

who are under the influence of alcohol

- Providing alcoholic beverages to

persons who are under the legal drinking age

- Laws or regulations affecting the sale,

gift, distribution or use of alcoholic beverages.

|

Examples: Scenario 1: The named insured is a medical supplies distributor and holds a company Christmas party where alcoholic beverages are served at no charge. Scenario 2: The owner of a printing operation takes a client to lunch and pays for a bottle of wine to go with the meal. Both scenarios are covered liquor liability situations if an

alcohol-related loss or injury occurs to the clients or guests. |

On the other hand, consider this:

|

Example:

Backinthewoods Liquor Manufacturing, Inc. sponsors a fundraiser by holding a

"Casino Night." The event includes betting and gambling

opportunities and the food and alcoholic beverages are provided for a charge.

Backinthewoods does not obtain the proper permits and licenses required for

the function. A patron served alcoholic beverages is injured on the trip home

from the event. Because this situation is subject to several state and local

statutes and ordinances and the insured is in the alcoholic beverage business,

coverage does not apply. |

Another method of handling an insured's liquor liability exposure is through a separate Liquor Liability Policy.

Related Article: CG 00 33 and CG 00 34–Liquor Liability Coverage Forms Analysis

Related Court Cases:

Liquor Liability Exclusion Held Applicable to Nonprofit VFW

Liquor Liability Suit Based on Failure to Restrain Patron Did Not Circumvent Exclusion

7. War

(Editorially changed wording from GL 0163–Exclusion – War and Military

Action)

The wording of the GL-200 is deleted and replaced with new wording.

The analysis of the GL-200 wording is as follows:

Coverage does not apply for bodily injury, property damage, personal injury and advertising injury arising out of war. The word war is expansive, including civil war, undeclared war, insurrection, revolution and rebellion, or an act or condition of war.

The replacement wording from GL 0163–Exclusion – War and Military

Action is analyzed as follows:

Loss or damage from any of the following

activities is specifically listed as excluded:

a. War and

this includes civil war and undeclared war

b. Warlike

action when such action is from any military force. Action that is taken to

stop or hinder the actual or expected warlike action is also excluded. The

military force must be part of a governmental, sovereign, or other authority

that is using the military personnel or agents.

This last sentence is very important because

without it coverage for riot and civil commotion could be excluded.

|

Example: A group of cat lovers petitioned and received approval to hold a

rally in the local park to protest a new law requiring license tags for cats.

Some dog owners were very upset because they thought the law was equitable

since dog owners already paid the license fee. They petitioned for a counter

demonstration. Things quickly got out of hand and Millie’s Dog Parlor, located

right next to the park, became caught in the middle of the action. A fight in

the parking lot between a large Persian and a Chihuahua ended up with damage

to several bystanders who tried to break up the fight. The injured bystanders

sued Millie. Because of the requirement that a sovereign military force had

to be involved for this war and military action exclusion to apply, Millie

had coverage for the suits. |

c. Insurrection,

rebellion, revolution, usurped power, or action a governmental authority takes

to hinder or defend against these

Note: This

exclusion does not have any exceptions. All loss or damage is excluded.

8. Intentional

There is no coverage for bodily injury or property damage when the insured expected, directed or intended the injury or damage. There is also no coverage if the injury or damage is the result of an act of the insured that is both intentional and malicious.

This exclusion protects the insurance company from responding to intentional damages or injuries caused by an insured. It acts in the public interest and guarantees that an insured is not using the insurance contract for personal gain, such as theft, to injure competitors, as an instrument of revenge, or for some other selfish or self-serving purpose.

Related Court Case: Intentional Damage Exclusion Barred Claims against Liability Insurer of Store Owner

There is an exception that applies only to bodily injury. If the insured intentionally causes bodily injury while protecting persons or property coverage apply but only if the force used is considered reasonable.

|

|

Example: Oscar hears a sound outside of his store and goes out the back door to investigate. Scenario 1: He sees three young men attempting to jimmy open his basement window. He fires a shot over their heads as a warning before calling 911. That single shot strikes a nearby pedestrian. While the shot was intentional, it was not malicious and was fired to protect the premises, so it is covered. Scenario 2: He sees three young men walking past his basement window and fires a shot into their midst, injuring one. Because there was no reason to protect the premises, this intentional act would not be covered when the injured young man sues. |

9. Products/completed Work Hazard

Coverage does not apply to bodily injury or property damage that is part of the products/completed work hazard except for the coverage provided under Coverage N.

This prevents duplicate coverage under Coverage L and Coverage N.

10. Pollution

The insurance company does not pay for bodily injury or property damage arising out of the actual, alleged or threatened pollutants discharge, dispersal, seepage, migration, release or escape. This absolute statement is followed by an explanation as to when and where it applies. This exclusion applies:

- When the event is at or emanates from any premises, site or location now or ever owned, occupied by, rented or loaned to the insured. There is an exception. If the injury or damage is due to the heat, smoke or fumes of a fire there is coverage but only if the fire becomes uncontrollable or it breaks out of the receptacle in which it was intended to be confined. This type of fire is commonly called a hostile fire. This means that pollution from a friendly fire would continue to be excluded.

|

Example: The

Jones family is a tenant in an apartment building. A fire breaks out in an

adjoining unit. The family becomes ill from the smoke and vapors from that

fire and develops serious, long-term health problems. They sue their

landlord. The landlord’s commercial liability coverage covers the bodily

injury sustained by the family because it is the result of a hostile fire at

the apartment building. The family also claims that the smoke caused the

deaths of their pet dog and cat. Those deaths could be covered because pet loss

would be covered as property damage. |

|

- When the event is at or emanates from any waste-related premises, site, or location. Waste-related means that is was used by anyone and at any time to handle, store, dispose of, process or treat waste.

Note: The hostile fire exception does not apply.

- When pollutants are considered waste and are being or were transported, handled, stored, treated, disposed of or processed as such. Coverage is excluded if the processes are being conducted by or for any insured or are being conducted by any other entity when the insured is legally responsible for that entity’s activities.

Note: There is no exception to this section.

- When the event is at or emanates from any premises, site or location where work is taking place. The work can be conducted by any insured or by any contractor or subcontractor that is under the control of the insured.

This part of the exclusion applies only under the following circumstances:

- The pollutants are brought on or to the premises, site or location in conjunction with such work by such insured. There is an exception. If the injury or damage is due to the heat, smoke or fumes of a fire, there is coverage but only if the fire becomes uncontrollable or it breaks out of the receptacle in which it was intended to be confined. This type of fire is commonly called a hostile fire. This means that pollution from a friendly fire would continue to be excluded.

Note: This also means that if the pollutants were brought onto the premises by someone other than the insured, this part of the exclusion does not apply.

- The work is the testing for, monitoring of, clean up, removal, containment, treatment, detoxification, neutralization or in any way responding to or evaluating the effects of pollutants.

Note: This paragraph is written in the present tense which means it excludes only pollutants related to current operations, not completed operations.

The insurance company does not pay any loss, cost or expense caused by, resulting from or arising out of any either of the following:

- Any manner of response to or evaluation of the effects of pollutants

- Any governmental authority lawsuit or claim regarding any manner of responding to or evaluating the effects of pollutants.

Pollutants are defined in this exclusion to be any solid, liquid, gaseous, thermal or radioactive irritant or contaminant. Acids, alkalis, chemicals, fumes, smoke, soot, vapor and waste are also considered pollutants. Waste is not limited to only items that are to be disposed but also includes items to be recycled, reclaimed or reconditioned. Electrical or magnetic emissions, whether visible or not, and sound emissions are also considered pollutants.

Related Court Cases:

- Contaminant Clarified With Respect to Application of Pollution Exclusion

- Environmental Cleanup Costs Held Not Covered by CGL Insurance

11. Employee

There is no coverage for bodily injury or personal injury to an employee of the insured if the injury occurs during that employment by the insured. In addition, coverage does not apply to consequential injury to a spouse, child, parent, brother or sister that is related to the injury of an employee.

This exclusion applies whether the insured is liable because it is an employer or because of any other relationship. If an action occurs whereby a third party pays and then comes back against the insured for injury to the insured’s employee, there is still no coverage. The only exception is if the insured assumed liability under a contract that is covered in Contractual Liability Supplemental Coverage.

Note: The intent of this exclusion is to eliminate duplicate coverage for injury that should be insured by employers liability coverage. The exclusion of work-related injuries applies regardless of the reason the insured may be held liable. It makes no difference if the liability is due to direct or indirect employment or by contract. All bodily injury and personal injury related to an insured’s work is excluded. This is particularly important to understand because of the widespread use of contractors, subcontractors, independent contractors or leased employees and because of the uncertainty of who is responsible for such workers.

Be careful of situations in monopolistic states where workers compensation is provided or required, but coverage for employer’s liability is not similarly necessary, required or available. This inconsistency can leave a major gap in coverage for the insured. Many insurance companies in such states offer their own endorsements to add employer’s liability coverage to the commercial liability coverage.

|

Example: Lizzie

works at Greater Cake Emporium. She is taking a break and admiring one of the

latest multi-tiered creations when the bottom holder suddenly breaks, and the

cake comes smashing down on her wrist, severely injuring her. Lizzie knows

that the injury is due to Greater Cake choosing the cheapest holders

possible! She sues Greater Cake in their capacity of a retailer and not as

her employer. There is no coverage for the suit because of the employee

exclusion. |

12. Workers Compensation and Other Benefits

The insurance company does not pay for bodily injury or personal injury when the insured either does or should provide benefits under laws such as workers compensation, disability benefits, occupational disease, and unemployment compensation. The intent of this exclusion is to eliminate duplicate coverage for injury that should be insured under workers compensation coverage and other mandatory types of insurance coverage.

|

Example: John’s

Roofing does not have any direct employees. Instead it uses ‘independent

contractors’ who work only for John’s Roofing, dress in John’s Roofing

required clothing, use John’s Roofing tools and follow the schedule John’s

Roofing supplies to them. When one of the ‘independent contractors’ falls and

injuries himself he submits a benefit claim to the workers compensation

board. The board rules that all of John’s ‘independent contractors’ are

actually employees and that John must compensate the injured employee and

must pay a fine for not carrying workers compensation coverage. The

commercial general liability policy will not respond because of this

exclusion. |

13. Employment-related Practices

Coverage does not apply to bodily injury or personal injury arising out of any employment-related practices activity. Examples of such practices are refusal to employ, termination of employment, coercion, demotion, evaluation, reassignment, discipline, defamation, harassment, humiliation, discrimination and sexual misconduct. The activities can be the policies, actions, omissions or consequential actions that result from them. This exclusion applies however the insured may be involved in such action. This means it is not limited to only its being an employer.

Related Article: Overview of the ISO Employment-Related Practices Liability Program

Related Court Case: Termination of Employee Was Not a Covered Occurrence

(Editorially

added wording from GL 1353–Exclusion – Data Breach Liability)

Data Breach Liability

- No coverage is provided for any bodily injury, property damage,

personal injury or advertising injury when it is due to or arises out of

information that is private or confidential being either disclosed or

accessed. The information can belong to any person or organization.

·

There is no coverage for loss, cost, expense, or damages due

to data records being corrupted, damaged, changed, or manipulated. It also does

not cover if they cannot be accessed or used.

Any expenses

resulting from of the following that are related to either of the above are

also excluded:

- Credit monitoring

- Notification

- Forensic investigation

- Legal Research

- Similar type expenses

(Editorially added wording from GL 1022–Information

Distribution and Recording Violations Exclusion)

Information, Distribution, and

Recording Violations

Coverage does not apply to property damage, bodily injury, personal

injury, or advertising injury that is due to actual or alleged direct or

indirect violations of any of the following:

- The Telephone

Consumer Protection Act of 1991 (TCPA)

- The Can-Spam Act

of 2003

- The Fair Credit

Reporting Act (FCRA)

- Similar local,

state, or federal ordinances, statutes, laws, or regulations that pertain

to, prohibits, or restricts any of the following as they relate to

information or material:

o Recording

o Collecting

o Transmitting

o Communicating

o Sending

o Disposing of

o Distributing material

- Amendments to any

of the specific acts above and any similar federal, state, or local laws

or regulations are also excluded.

(Editorially

added wording from GL 890–Lead Liability Exclusion)

Lead Liability

Exclusion

- No payment will be made for any of the following:

- Bodily injury that is in any way caused by lead of any form being

ingested, inhaled or absorbed.

- Property damage, personal injury or advertising injury related in

any way to any form of lead.

- Any loss, cost or expense caused by, resulting from or arising out

of any either of the following:

·

Any

manner of response to or evaluation of the effects of lead

·

Any

governmental authority lawsuit or claim regarding any manner of responding to

or evaluating the effects of lead.

ADDITIONAL EXCLUSIONS THAT APPLY ONLY TO PERSONAL INJURY AND/OR ADVERTISING INJURY

1. Violation of Law

There is no coverage for personal injury or advertising injury when the insured willfully violates an ordinance, law, regulation or statute. It also doesn’t cover when someone else performs the action but does so with the insured’s consent.

|

Example:

Joiner, Inc. has obtained a restraining order preventing John Smith, a

persistent salesman, from entering its premises. John Smith’s bosses want

John to continue to approach the employees at Joiner. When John is caught on

premises and Joiner, Inc. sues John’s employers, there is no coverage for

either John or his employers because they were operating in violation of a

court order. |

|

2. False Material and Publication Prior to Policy Period

The insurance company does not pay for personal injury or advertising injury when known false material is published (oral or written) by or at the direction of the insured. There is also no coverage when the offense is based on any material that had been published by any party prior to the policy period.

3. Breach of Contract

Coverage does not apply when an advertising injury is due to a breach of contract. The one exception is when an advertising idea is misappropriated through an implied contract.

|

Example: Jerry sent a suggestion to Make My Day Enterprises for an ad campaign. They sent a reply thanking him for his suggestion. Three years later Jerry noticed that the Make My Day ad campaign looked just like what he had suggested. Because of the letter he had received he felt he had an agreement, so he sued them for breach of contract. Because the contract was only implied, there is coverage. |

4. Quality or Performance of Goods

There is no coverage for advertising injury when the goods or services do not meet the level of quality or performance advertised.

5. Insureds in Media Business

If the insured is in the business of publishing, advertising, telecasting or broadcasting there is no coverage for any advertising injury offenses.

6. Wrong Description of Prices

When the wrong description of the prices of the insured's goods, products or services in an advertisement is the cause of advertising injury, there is no coverage.

7. Pollution

This is an absolute pollution exclusion.

There is no coverage for personal injury or advertising injury arising out of the actual, alleged or threatened discharge, dispersal, seepage, migration, release or escape of pollutants at any time.

The insurance company does not pay any loss, cost or expense caused by, resulting from or arising out of any either of the following:

- Any manner of response to or evaluation of the effects of pollutants

- Any governmental authority lawsuit or claim regarding any manner of responding to or evaluating the effects of pollutants.

Pollutants are defined in this exclusion to be any solid, liquid, gaseous, thermal or radioactive irritant or contaminant. Acids, alkalis, chemicals, fumes, smoke, soot, vapor and waste are also considered pollutants. Waste is not limited to only items that are to be disposed but also includes items to be recycled, reclaimed or reconditioned. Electrical or magnetic emissions, whether visible or not, and sound emissions are also considered pollutants.

Because of certain coverage wording in previous editions of personal injury and advertising injury liability coverage forms, attempts have been made to force coverage for various types of pollution losses into it by referring to it as trespass, wrongful entry or invasion of the right of private occupancy. The personal or advertising injury coverage was never intended to pay for pollution damages or cleanup costs. This exclusion clarifies that no coverage exists for any pollution exposure that may arise out of the personal and advertising injury wording in the policy.

ADDITIONAL EXCLUSIONS THAT APPLY ONLY TO PROPERTY DAMAGE

1. Fire Legal Liability

The only property damage coverage

for property owned or occupied by, or rented to, the named insured is that which

is provided by Coverage O–Fire Legal Liability.

2. Sold or Abandoned

Coverage does not apply to

property damage to premises sold, given away or abandoned by the named insured,

if the property damage arises out of any part of those premises. The exception

to this exclusion is premises that were the named insured's work and were never

occupied, rented or held for rent by the named insured.

Note: This is particularly important to a homebuilder. Before this exception was added, homebuilders had no coverage on buildings that they had built and sold. However, it is important for such builders to realize that once they put a building into use, such as a model home with an office inside, or as a rental, the exception no longer applies.

3. Used By or Loaned To

Property that is used by or loaned to the named insured is not covered for property damage. The exception to this exclusion is any liability assumed under a sidetrack agreement.

A sidetrack agreement is one between a property owner and a railroad company, with respect to a railroad sidetrack on the premises of the insured. A sidetrack is a transfer or access track. The railroad company allows use of the sidetrack by the property owner if the property owner guarantees access to the sidetrack by the railroad company and agrees to certain conditions of property maintenance. A mutual hold-harmless agreement between the railroad company and the property owner may also be required.

4. Care, Custody or Control

There is no coverage for property damage to any type of personal property while that property is in the insured's care, custody or control. The exception to this exclusion is any liability assumed under a sidetrack agreement.

Note: Although the commercial liability coverage form does not have an endorsement that provides coverage for property in the insured's care, custody, or control, many insurance companies have developed their own forms or endorsements to do so. In addition, Inland Marine Bailees insurance is available that covers the property of customers or clients in the care, custody or control of the insured. There are various forms of this coverage available through the American Association of Insurance Services (AAIS), the Insurance Services Office (ISO), or individually developed and filed specific company endorsement forms, depending on the nature of the insured’s operations.

Related Articles:

AAIS Bailee Customers Floater Coverage–Dry Cleaners And Laundry Form Coverage Analysis

ISO Bailees Customers Coverage Form Analysis

5. Specific Part of Real Property

Property damage to the specific part of real property that is being worked on is not covered if the property damage arises out of that work being performed. This applies if the work is being performed by the named insured or by a contractor or subcontractor working directly or indirectly on behalf of the named insured. Once again, this exclusion does not apply with respect to liability assumed under a railroad sidetrack agreement.

|

|

Example: Freda has been hired by Roger to install a skylight in his roof. When she cuts the opening for the skylight, she inadvertently nicks a water line. She completes the task and collects her money. Freda is very surprised to receive a suit claiming that she had caused a major leak in the piping that resulted in water and mold damage to the roof, insulation, ceiling and walls. There would have been no coverage for the damage to the roof or to the skylight but because the only item damaged by Freda was the piping and that was not the part of the real property she was working on, coverage would apply for all the damage. |

6. Specific Part of Property

Property damage to that specific part of any property that must be restored, replaced or repaired because mistakes in the named insured's work are not covered. There are two exceptions to this exclusion. If the property damage is considered products/completed work hazard there is coverage. Also, liability assumed under a sidetrack agreement is covered.

|

Example: Freda

nicked the piping in the above example and it must be repaired because of

Freda’s mistake. Therefore, the piping repair and replacement is not covered

because of this exclusion. |

Related Court Case: Property Damage Exclusion Held Applicable To Entire Renovation Area

7. Named Insured’s Products

Property damage to the named insured’s products is not covered when the damage is a result of the products themselves or their parts.

|

Example: Green

Furnace and Design manufactures gas furnaces. An installed furnace

malfunctions and catches fire. There is no coverage for the furnace. However,

there would be coverage for the damage caused by the furnace. |

8. Named Insured’s Work

Property damage to the named insured's work is not covered if the property damage arises out of the named insured's work and the work is considered a products/completed work hazard. There is an exception. If the property damage arises from work done by a subcontractor working on behalf of the named insured there is coverage.

|

Example: Gene’s

Builders repairs the electrical wiring in a building. When the wiring