FL 00 20–ISO FARM PROGRAM LIABILITY COVERAGE FORM ANALYSIS

(April 2020)

|

|

The analysis is based on the 04 16 edition of the coverage form. Changes from the 09 03 edition are highlighted in bold.

FL DS 20–ADVISORY FARM LIABILITY COVERAGE FORM DECLARATIONS

This is an advisory declarations page but the information contained on this declarations is mandatory. The coverage form makes many references to the declarations, so the information on it must be accurate. The declarations should be reviewed carefully and the company notified concerning changes and corrections in writing. This declarations is used with the FL 00 20–Farm Liability Coverage Form.

General Information

The policy number, insurance company name, address, insured name, mailing address, and policy period must be entered in this section. The mailing address is particularly important because it is used to mail any notice of cancellation. The policy period starts and ends at 12:01 a.m. at the mailing address.

Form of Business

The form of business must be selected. If there are more than one named insured, more than one form of business may be selected. The selections affect the definition of insured so the entry is important.

Description of Premises

This section is used to identify the premises and location. It should be described as completely and accurately as possible because there can be coverage consequences based on this information. This section also provides an opportunity to expand the coverage. If a retail activity is listed (and described), the definition of farming is expanded to include the retail activity. In addition, any mechanized processing functions are covered, but only if listed and described in this area.

Limits of Insurance

This policy consists of three separate coverage parts. Part H provides Bodily Injury and Property Damage Liability coverage. Part I insures Personal and Advertising Injury Liability coverages. Part J applies to Medical Payments coverage. Each insured coverage must have its limits entered on the declarations in order for that coverage to apply. The method of applying the limits is described in the coverage form but the declarations show the coverages provided and the limits that apply.

Aggregate

Coverages H, I, and J are subject to a single annual General Aggregate limit. This is the most the insurance company will pay in any policy year for all covered losses.

|

Example: Mary had nothing but bad luck this year. First was the “horse incident” which cost $250,000. Then a slander lawsuit was settled for $200,000. Finally, an accident during a school tour settled for $100,000. Unfortunately, Mary’s bad luck got worse. Her policy general aggregate limit was only $500,000 and her claims total was $550,000. She had to pay $50,000 of these claims out of her own funds and also had to be personally responsible for any other payments that occurred for the rest of the year’s policy term. |

Each Occurrence Limit

Coverage H and Coverage J are each subject to an occurrence limit. This limit must be entered in this section.

|

Example: Two boys were playing near some farm machinery and fell into the equipment. The farmer saw the situation, stopped the machinery, and called 911. Both boys sustained serious injuries that required emergency surgery and lengthy, expensive rehabilitation. The families of both boys sued the farmer. One family agreed to a $250,000 settlement. The other settled for $300,000. Because the policy occurrence limit for this coverage was $300,000, the farmer was personally responsible for the remaining $250,000. |

Any One Person or Organization Limit

Coverage I, Personal and Advertising Injury Liability is subject to a limit for each person or organization. The limit must be entered in this section.

Any One Fire (Premises Rented to Insured)

Coverage H has a separate Fire Damage Limit that must be entered in this section. The standard limit is $50,000 for any one fire and applies to premises rented or leased to the insured.

Any One Person Limit (Except Residence

Employee)–Any One Residence Employee

Coverage J allows for two different limits. One limit is an any one person limit and does not apply to residence employees. The other limit is an any one person limit that applies only for residence employees.

Additional Coverage 2–Damage to Property of

Others

This coverage is explained in the coverage part and has a limit of $1,000 per occurrence. There is no provision for increasing this limit.

Custom Farming

If receipts from custom farming exceed $5,000, the actual estimated receipts are entered in this area.

Incidental Activities on the Farm

All incidental activities must be listed in this section, including the location where those activities occur or take place.

Residence Employees

The number of residence employees, if any, in excess of two must be indicated in this section in the space provided.

|

Example: Hannibal and Clarice Edem own “Sheared Acres,” a very successful sheep farm. Their mansion-size farm home has a domestic staff that includes a chef, three domestic employees, two gardeners, and three repair people. Under the Residence Employees section of their policy declarations, the number shown is seven. |

|

Additional Farm Premises

All premises, other than the primary residence, maintained by the named insured must be listed. In addition, any premises owned by the named insured and rented or leased to others must be listed and described.

Additional Insured - Farm Liability

If applicable, an additional person who has ownership interest in the farm operation may be listed. This option only applies to persons who do not reside on the insured premises and who are NOT part of a partnership, corporation, or other entity already listed as an insured.

Forms Applicable

This section lists all the form numbers that apply to the policy. The listing does not usually include form titles or descriptions. All forms listed should be included with the policy when it is issued. All forms should be reviewed periodically to be certain that they are appropriate, applicable and agreed to by the insured.

Premium Payable

The final policy premium is shown on the declarations and should be the same as the premium quoted. If the figures do not agree, the issue should be addressed and resolved promptly, since the premium is due and payable immediately.

FL 00 20–ISO FARM PROGRAM LIABILITY COVERAGE FORM

INTRODUCTION

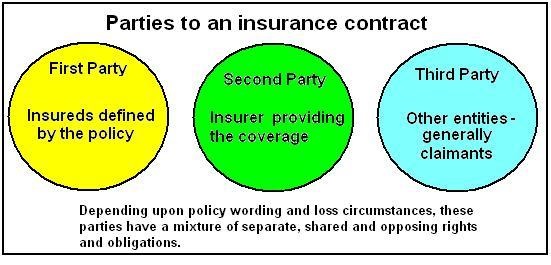

The entire form must be reviewed in order to understand how coverage applies. The terms you and yours in the form mean the named insured. Us, we, and ours refer to the insurance company. The other definitions that apply to this coverage form can be found in Section IV-Definitions.

Note: Under

Coverage Extension – Coverages H, I and J, the named insured is broadened to be not only

the person named on the declarations but also that person’s spouse if living in

the same household.

SECTION I–COVERAGES

COVERAGE H–BODILY INJURY AND PROPERTY DAMAGE LIABILITY COVERAGE

1. Insuring Agreement

The company agrees to pay all sums the insured is legally obligated to pay as damages because of bodily injury or property damage but only if the insurance coverage in the form actually applies to the loss or damage.

The company has the right and the duty to defend a suit against the insured for damages that are covered under the policy. The insurance company may also provide a legal defense to preserve or protect its own interest as well as, or instead of, the insured’s.

|

Example: George’s bull crossed over to a schoolyard and gored a child. George is devastated and just wants the case settled. He tells the insurance company to just pay the whole thing. The insurance company informs George that the loss circumstances should be examined and the need for payment should be resolved by taking the case to court. If George wants insurance coverage for this loss, he must stand by the company and assist in the defense. |

If the insurance does not apply, the insurance company has no obligation or requirement to defend.

|

Example: The insurance company discovers that George’s 20-year-old son (who is a resident of the insured household) opened the gate and sent the bull over to the schoolyard. It was meant as a prank played on a teacher friend of his at the school but the child appeared unexpectedly. Because this was an intentional act, coverage does not apply and the insurance company is not obligated to provide a defense. |

|

The company decides when and how to investigate a loss and has complete control on how to settle a claim. A company can assert its right, even if it is against the insured’s wishes. Once the applicable policy limit as described in Section II is used up in payment of judgments, settlements, or medical expenses, all duties and rights of the insurance company to defend end.

A loss involving bodily injury or property damage must occur during the policy period in order to trigger coverage. Any bodily injury or property damage prior to the policy period and known by an insured or by an authorized employee is not covered. This bar to coverage extends to any related, additional damages that occur during the policy period. For the purpose of excluding an occurrence, the controlling date is the date when any insured, or anyone authorized to act for an insured, becomes aware of bodily injury or property damage.

|

|

Example: Phil lived on a rental dwelling on Paul’s farm. Phil told the farm manager that his wife became ill and the doctor thought it was due to carbon monoxide poisoning. The farm manager said he would look into it but did not. Two weeks later, the entire family wound up in the hospital with the same condition. Phil and his family moved to a new residence and filed a lawsuit against Paul a few months later. Paul’s insurance policy expired the day after the initial carbon monoxide case and the insurance was now with a new carrier. The previous policy did not cover bodily injury due to fumes but the current one does. A claim was presented to the new insurance company. They denied it when they learned that the farm manager knew about the incident before the policy effective date. |

Bodily injury coverage includes claims by any person or organization seeking damages for the care of, loss of services of or death resulting from bodily injury to a person.

2. Exclusions

Policy coverage does not apply to any of the following:

a. Expected or Intended Injury

If the insured expects or intends to cause bodily injury or property damage, there is no coverage for that damage, even if the injury is different from the purpose of any action or if the person or entity injured was not the intended victim or target. If any intentional action is related to the effort needed to protect other persons or to protect property, coverage applies to the resulting bodily injury loss.

|

|

Example: Willy just planned to have fun when he hid in a tree and waited for his friend Artie to ride by on his bike. He planned to drench Artie with his high-powered Wet Whomper water gun. Willy knew the timing had to be perfect, so he got ready as soon as he heard the bike and fired before he actually saw Artie. His victim turned out to be Mrs. Martin, who had her baby on the back of the bike. The water blasts caused her to lose control of the bike and both she and her baby tumbled off the road and into a ditch. Each of them spent more than a week in the hospital and both underwent significant rehabilitation. Willy’s father’s policy denied coverage because the action was intentional, even though the victims were not the ones intended and the injuries weren’t foreseen. |

b. Contractual

Liability

Any contractually assumed liability is excluded except for:

· Coverage that existed even without a contract.

· If an insured contract is in place. Defense coverage for insured contracts exists if included as an element of the contract and coverage applies. The defense coverage,(which includes alternative dispute resolution expenses, is part of the limit, not in addition to it, except as noted in the Additional Coverages, Supplementary Payments section.

|

Example: Mary sells her eggs through the local store. She signed an agreement with them stating they would be covered, including legal defense expenses, in the event of a lawsuit due to the eggs. Five different customers recently filed food poisoning claims against the store and they were immediately presented to Mary. Because the contract qualifies as an insured contract and defense was included, the company will defend both Mary and the store. |

|

c. * Pollution (04 16 change)

Bodily injury or property damage due to pollutants is not covered:

· At any premises that is or was owned or occupied by or rented to an insured. An exception applies for injury or damage in a building caused by heating equipment or any injury or damage caused by hostile fire, which are covered.

· At any place where waste was or is disposed of or treated.

· For any waste transported, handled, or processed by or for the insured (or by or for any entity that an insured holds legal responsibility).

·

At a premises or location of the insured where

contractors are working on the insured’s behalf and where pollutants are

brought on the location or premises. Three exceptions apply. The first is when pollutants escape from

the part of a vehicle that is designed to hold fluids for the use of the

vehicle. This exception does not apply if the escape was intentional. The second

is for injury or damage in a building caused by heating equipment. The

third is for injury or damage caused by hostile fire, which is covered.

- At any premises where testing, monitoring, cleanup and other pollutant-related activities are being conducted by the insured or on the insured’s behalf.

In addition, loss costs or expenses related to meet statutory demands for pollutant-related activities are not covered, unless coverage would have applied even without the statutory demand.

|

Example: The Millers have always had an underground gasoline storage tank on their premises for all of the different equipment they use. It was installed before World War II and remains there to this day. There have been complaints recently of a gasoline smell in the water downstream and local officials requested that the Millers test their tank for leaks. The Millers looked to the insurance company for coverage but their request was denied, because the policy provides no coverage for testing. The testing revealed that the tank was leaking and the Millers again looked to the insurance company for coverage to clean up the damage. Their request was denied again. Now the neighbors discover that their property is polluted by the gasoline from the Millers and are suing. The Millers turn to their insurance company for the third time, seeking coverage and defense, and are denied for the third time as well. |

Some limited pollution coverage is available using the mandatory FL 01 63–Amendatory Endorsement Form. Additional pollution coverage can be purchased using FL 04 03 or FL 04 30, both titled Limited Farm Pollution Liability Extension Endorsement. When either of those forms are used the FL 01 63 is not attached.

Related Articles:

ISO Farm Program Policy Available Endorsements and Their Uses

Underground Storage Tank Policy Analysis.

d. * Release or Discharge from Aircraft

If a substance released or discharged from an aircraft causes bodily injury or property damage, coverage does not apply unless the aircraft is either a hobby craft or a model and is not capable of carrying either cargo or passengers.

|

Example: Brad hired a friend (under a written contract) to spray his fields. Brad arranged the mixture and even went up with Charlie to oversee the job. Spray from the dusting drifted to the premises of an auto dealership about five miles away. The chemicals damaged the finish on over 50 cars. Brad and his friend were sued because of the contract. When Brad contacted his insurance company for coverage, his claim was denied because of this exclusion. |

|

Coverage for crop dusting by an independent

contractor can be purchased using endorsement FL 04 44–Coverage for Physical

Injury to Crops and Animals Due to Certain Crop Dusting Operations Performed by

Licensed Independent Contractor by Aircraft.

Related Article: ISO Farm Program Policy

Available Endorsements and Their Uses

e. * Aircraft, Motor Vehicle, Motorized

Bicycle or Tricycle

Bodily injury and property damage due to aircraft, motor vehicles or motorized bicycles or tricycles owned, used, maintained, or entrusted to others is not covered if they are owned, operated, rented or loaned to an insured. Coverage does not apply when stopped, being loaded, moving, or being unloaded. There is also no coverage extended vicariously from the actions of a child. Finally, there is no coverage for an occurrence due to poor supervision, training, or monitoring on the part of any insured.

The exclusion does not apply to aircraft related bodily injury to a resident employee as long as that employee was not operating or maintaining an aircraft. It also does not apply to the parking of a non-owned motor vehicle, bicycle, or tricycle on of next to the premises. The exclusion does not apply to a motor vehicle not subject to motor vehicle registration because it is used only on premises or used only as a device for assisting the handicapped. This exclusion also does not apply to licensed recreational motor vehicles used on premises and mobile equipment.

Note: The aircraft exception applied to both bodily injury and property damage in prior edition but in this edition applies only to bodily injury.

Snowmobiles can be covered for off-premises operations by purchasing endorsement FL 04 71–Owned Snowmobile Coverage and completing the schedule for all applicable units. All-terrain vehicles can be covered using endorsement FL 04 74–All Terrain Vehicle Coverage.

Another coverage exception is for BI or PD connected to operating farm machinery or equipment that is part of equipment that, ordinarily, would qualify as mobile equipment except for the laws of the jurisdiction in which it is located or garaged. Coverage also still applies to machinery and equipment that qualifies under paragraphs f. (2) and (3) of this form’s definition of mobile equipment.

f. * Watercraft (04 16 change)

Note: The changes in this exclusion are

formatting but not coverage.

The term excluded watercraft is used in this exclusion. The term means any watercraft propelled by engine or electric power or that is sailed. The watercraft can be either rented to or owned by an insured.

Bodily injury and property damage that arises from excluded watercraft that is owned, used, maintained, or entrusted to others is not covered. There is no coverage when it is stopped, being loaded, moving, or being unloaded. There is also no vicarious liability coverage due to the actions of a child and no coverage applies if the occurrence is due to poor supervision, training, or monitoring on the part of any insured.

The exclusion does not apply in the following circumstances:

- Non-sailing watercraft powered by:

o One or more outboard engine or motor with less than 25 horsepower

o Outboard engines or motors that are more than 25 horsepower that are owned by the insured and are acquired during the policy period. If they were acquired prior to the policy they are also covered if declared at inception or within 45 days of acquiring them a notice is sent in writing to the insurance company.

o Inboard/outboard engines with less than 50 horsepower if non-owned but if both non-owned and not rented by the insured inboard/outboard engines with more than 50 horsepower are ok.

- A sailing watercraft regardless of auxiliary power source that is:

o Less than 26 feet long

o Greater than 26 but are neither owned nor rented by an insured.

· Any boat in storage

· Bodily injury or property damage on the insured location or sustained by a resident employee in the course of his or her duties.

|

Example: The Farley family had a Farm Liability policy. They loved boating and were looking at various models at the local dealership. The dealer offered to let them take one for a spin. Junior took the dealer too seriously and put the boat into an awkward spin, ending with him careening into two other boats and a dock. Father Farley called his insurance agent and was pleasantly surprised to learn that coverage was available because the boat was neither owned nor rented. As a result, it was not a boat excluded by the policy. As an aside, the boat dealership also paid out money on this claim because they also bore some responsibility for the situation. |

|

Coverage is available by attaching endorsement FL 04 83–Watercraft.

Related Article: ISO Farm Program Policy Available Endorsements and Their Uses

g. * Mobile Equipment

Any damage caused by mobile equipment while transported by an insured owned, rented, operated, rented, or loaned motor vehicle is not covered. Insurance also does not apply to mobile equipment to be used or being used in a pre-arranged speed, endurance or other type of contest or stunt.

|

Example: The tractor pull was the major event at the county fair

and Keri’s old tractor was definitely souped-up and ready to go. Shortly

after her match began, the tractor engine let loose and parts flew

everywhere. Seven persons were taken to the hospital for treatment and every

one of them sued Keri as soon as they were able. Keri looked to her policy

for coverage and this exclusion was carefully explained to her, because it

was the basis for the claim being denied. |

|

h. * Use of Livestock or Other Animals

Any bodily injury or property damage caused by livestock included as part of any prearranged racing, speed or strength competition while at the site of such a competition is excluded. There is also no coverage when livestock are used to provide rides for a fee at a fair or charitable event. Coverage for animals in contests or stunts is available using endorsement FL 04 40–Animals in Contests or Stunting Activities. Coverage for animal rides can be purchased using endorsement FL 04 41–Animal Rides for Profit or Charity.

|

Example: Barney and Andy were taking their racehorse, Winnie, to her next race. While the truck and horse-trailer were stopped at a traffic signal, Winnie smashed open the trailer door and bolted onto the street. By the time Barney and Andy finally caught up to her, she had damaged seven vehicles. The insurance company received this unusual claim and promptly paid it, because this policy exclusion only applies when the animal is actually at the site of the contest or event. |

i. * Business Pursuits

Bodily injury or property damage resulting from any non-farming business is not covered, with one exception. This exclusion does not apply to a part-time business conducted by a member of the household under the age of 21 and having no employees. Property damage under this exception applies only to non-insureds.

|

|

Example: Martha is an excellent seamstress and makes her own window coverings. She recently started making window treatments for friends and this has become a nice money making operation. Unfortunately, she was hanging some curtains at a client’s home recently and dropped the curtain rod on the client’s three-year-old son. Martha paid the significant hospital bill. When she asked her insurance company for reimbursement, they denied the claim because the business pursuit is separate from and outside the farming operation and excluded. |

The exclusion can be modified for Day Care Operations only, using FL 04 42–Limited Home Day Care Coverage or for any scheduled business operations using FL 04 43–Business Activities.

j. * Custom Farming

There is no coverage for bodily injury or property damage arising from the insured’s performing or failure to perform any custom farming operations. This exclusion does not apply if the income generated by this activity is less than $5,000 for the 12 months prior to the occurrence.

Note: This is not the prior year’s activities. Instead it is a rolling 12 months that includes the current year’s activities.

|

|

Example: Robert needed a new baler. As he looked at balers on

dealers’ lots, he realized the only way he could afford one was if he could

provide baling services for his neighbors. He checked with a number of them

and they agreed to his terms, so he bought a baler. In the fall, Robert

worked his field first and then set out to do the others. By the time he got

to the last field, part of the gear became misaligned. It wasn’t until he had

performed a full day’s work that he noticed the hay bales were not properly

bound and were mangled. The crop’s owner sued Robert for property damage.

Because Robert’s custom farming revenue already exceeded $5,000, the insurance

company denied coverage. |

Coverage can be expanded when receipts exceed $5,000 by attaching endorsement FL 04 69–Custom Farming Liability Coverage.

k. * Professional Services (04 16 change)

Coverage does not apply to bodily injury or property damage resulting from providing or failing to provide any professional services. This means that neither providing of services nor the refusal to provide services is covered.

Allegations of negligence supervision, hiring, employment, training, or

monitoring of others in their professional actions are also not covered.

|

Example: Alice is a well-known veterinarian who specializes in cats and dogs. She consistently refuses to treat larger animals. Her neighbor called her in distress, because their prize hog was ill. Because they were good friends, she went over to see the hog. However, she abruptly stated that she did not treat large animals and rushed back home. When the hog died from lack of treatment, the neighbors sued Alice because she refused to help. Alice submitted the claim to the insurance company, who denied coverage because it involved a professional service. If Alice had sent an employee to help instead of going herself, coverage would still not have applied. As a veterinarian, Alice should have veterinarians professional liability coverage, which would respond in this case.

|

l. * Rental of Premises and Ownership or

Control of Premises

The farm liability policy does not respond to bodily injury or property damage involving an insured’s ownership, occupation, or rental of a location that is not named or listed as an insured location on the policy. Coverage also does not apply to bodily injury or property damage that occurs at an insured location that is rented or leased to others or that is made available for rental.

In the first instance listed above, there is an exception for injuries to residence employees. In the second situation, there are several exceptions. Coverage still applies if the rental matches any of the following:

· Is for the purpose of farming and the premises is shown on the Declarations as a rented premises or is not on the Declarations but the rental starts or the rented premises was purchased during the policy period.

· Involves a residence on a farm that is shown on the Declarations as rented to others or is not on the Declarations but the rental starts or the rented premises was purchased during the policy period.

· Is within the named insured’s principal residence and consists of only one or two boarders, occurs only occasionally, or involves use of such space as a school, office, studio, or private garage.

|

Example: After many years of farming, Mary and Tom decide to keep their farm but move to town and turn over the operation to their son. Tom dies soon after the move and Mary decides to start renting out the extra rooms. It works so well that she has four boarders move in within the space of one year. One night she serves an undercooked chicken for dinner, everyone suffers food poisoning and all four boarders end up with expensive hospital stays. They present their bills to Mary and she forwards them to her insurance company. They deny the claim because the residence has more than two boarders and because it is not Mary and Tom’s principal residence. |

|

m. * Communicable Disease

Bodily injury or property damage that occurs because a communicable disease is transmitted by an insured is not covered.

n. * Workers Compensation or Similar Law

Coverage under this policy does not respond or apply to a loss covered by workers compensation or a similar law.

Related Article: WC 00 00 00 A–Workers Compensation And Employers Liability Insurance Policy Analysis

o. * Employers Liability

Farm liability coverage does not apply to bodily injury loss to an employee while working for any insured. The exclusion also applies to members of an injured employee’s household, who may suffer a consequential loss as a result of the excluded injury to the employee.

|

Example: Sam slips on a wet spot on the floor while milking the dairy cows. His back is severely wrenched and he lies in agony for almost two hours before his boss finds him. During a four-month recuperation period, Sam becomes angry, remembering how he repeatedly told his boss about the damp area of the floor. Somehow, his boss never got around to fixing a leaky hose that caused the problem. Sam becomes so angry that he sues his boss. The surprised boss turns the papers over to his insurer and is surprised when the company promptly denies the claim. |

|

There is no coverage for

the insured as employer or in any other capacity. There is also no coverage

when the insured employer is required to share in the loss because of other

types of obligations.

Coverage does apply if a situation is part of an insured contract. It also applies for a residence employee but only if the claim is presented to the insurance company within three years after the policy in which the loss occurred expires.

Coverage for farm

employee employers’ liability is available using endorsement FL 04 65–Farm

Employers Liability and Farm Employees Medical Payments Insurance.

Related Article: ISO Farm Program Policy Available Endorsements and Their Uses

p. * Building or Structure under Construction

There is no coverage for bodily injury that occurs because of the construction of any building or structure at any location or premises, unless the injury involves residence employees or persons other than insureds. Furthermore, in order for the exception to apply, the construction must be of either a dwelling or a structure for farm operations and the site must be an insured location.

|

|

|

Example: Tom owns a farm and Jack is his farm manager. Tom's nanny, Brunhilda, takes care of his two girls as well as Jack’s daughter, Ford. When Brunhilda brings their lunches to them one day, she discovers they are gone. She starts her search where the new barn is being built. She shrieks when she notices Tom’s daughter Megan dangling from the loft. Megan loses her grip and falls directly on Brunhilda. Megan's sister, Tiffany, and Ford also jump, landing in large sawdust piles. At the end of it all, Megan has a broken leg, the other two girls have lacerations and sprains from the fall, and Brunhilda has a broken leg and a lot of aches and pains. The claims are submitted to the insurance company. Megan and Tiffany are insureds, so no coverage applies to them. Brunhilda is covered because she is a residence employee and Ford is covered because she is third party. The building meets the exception to the exclusion under the policy. |

q. * Bodily Injury to an Insured

There is no coverage for bodily injury to any insured, even if it is a claim to share an obligation or to repay an obligation.

r. * Damage to Property (04 16 change)

Coverage does not apply to property damage to any of the following property:

· Property owned by the named insured, including any work done as a loss-prevention measure

· Rented or owned property

· Property that was sold, given away or abandoned by the named insured but only when the property damage comes from all or any part of the premises.

· Any property that is loaned to the named insured unless liability has been assumed in a sidetrack agreement.

- Personal

property in the care, custody, or control of any insured except as related

to custom farming. The custom farming exception applies only when the

custom farming receipts are no greater than $5,000 for the 12-month

preceding the date of a loss. (This requirement is distinct from $5,000 per

year.) Liability that has been

assumed in a sidetrack agreement is an exception to this exclusion.

s. * Damage to Your Product

Property damage to the named insured’s product as a result of a problem within the product or within any part of the product is not covered.

t. * Damage to Your Work

Property damage to the named insured’s work because of a part of that work, or a part of that work that must be repaired or replaced because the work was done incorrectly, is not covered. This is considered and sometimes called the faulty workmanship clause and is important because the insurance company should not have to pay for inferior workmanship. The named insured must be responsible for correcting the problems. One exception to this exclusion is for custom farming if the custom farming receipts do not exceed $5,000 for the 12 months prior to a loss.

u. * Damage to Impaired Property or

Property Not Physically Injured

There is no coverage for loss of use of property caused by a problem with the named insured’s product or work. The problem must be due to either a defect or deficiency in the named insured’s product or work or because of the failure of the named insured to perform a contract. This exclusion does not apply to custom farming operations where revenue is less than $5,000 for the 12 months prior to a loss.

Coverage does apply if the loss of use occurs after the named insured’s product is put into service and a sudden and accidental event occurs.

v. * Recall of Products, Work or Impaired

Property

There is no coverage for damages, cost, or expenses that occur with or result from a product recall.

|

Example: A number of children become ill after drinking milk at school. The milk supplier traces it back to the responsible dairy. The dairy issues a recall for all milk in a certain batch processed in a particular vat that was not cleaned properly. There is no coverage for the costs and expenses of the recall, even though there is coverage for the bodily injury claims that will be presented. |

w. Sexual Molestation, Corporal Punishment or Physical or Mental Abuse

This exclusion is normally found in personal lines liability policies, not commercial lines liability policies. It is appropriate in this policy because farm risks have both personal lines and commercial lines aspects. There is no coverage for bodily injury or property damage due to sexual molestation, corporal punishment or physical or mental abuse. This exclusion is intended to be an absolute bar against coverage for such claims.

Related Court Case: Insurer Owes Duty to Defend Insureds for Negligence in Hiring and Supervising Employees Involved In Molestation on Business Premises

x. Controlled Substances

There is no coverage for bodily injury or property damage due to controlled substances. The exclusion defines a controlled substance and specifies that legitimate prescriptions drugs are not part of this exclusion, provided they are prescribed by a licensed physician.

|

Example: Melissa often arranges play dates in her home. Last week five additional kids were wandering through her house. Scenario one – One child found her Valium prescription and ingested some pills. Fortunately, Melissa found the bottle and rushed the children to the hospital. When the parents presented the hospital and medical bills to Melissa, she forwarded them to the insurance company and they were paid promptly. Scenario two - One child found a bottle of Valium and ingested some pills. A friend of Melissa gave it to her after she got over her illness. Fortunately, Melissa found the bottle and rushed the children to the hospital. When the parents presented the hospital and medical bills to Melissa, she forwarded them to the insurance company and coverage for the medical expenses was denied because a doctor hadn’t prescribed the drug to Melissa. |

y. Personal Injury

Bodily injury due to personal injury (such as libel or slander) is not covered. Consequential bodily injury due to personal injury is covered in the Personal and Advertising Injury Liability Section. This exclusion eliminates the possibility of duplicate coverage in the same policy.

Related Court Case: Mental Anguish from Alleged Libel Held Covered When Unintended

z. Recording and Distribution of Material or

Information in Violation of Law (04 16 name and coverage change)

This exclusion makes the policy inapplicable to either bodily injury or property damage that is related to the sending out of information that is commonly called spam (essentially unsolicited promotional material). No coverage exists for incidents that are considered illegal under the Telephone Consumer Protection Act, the CAN-SPAM Act, Fair Credit Reporting Act, Fair and Accurate Credit Transaction Act or under any similar law.

|

Example: Amazing Milk Dairies is sued by an irate group of businesses that received unsolicited faxes from Amazing that was sent out to promote its new line of yogurt. Amazing sends in a claim to its insurer, asking to be defended against the lawsuit, but the claim is denied since the fax distribution violated a state law that banned unsolicited advertisements. |

|

aa. * War

This exclusion bars coverage for all losses involving military and similar actions, including civilian protests. The bar to coverage is broad, extending even to losses related to an insured attempting to defend against such incidents.

Note: This exclusion does conflict with the policy exception that is made for acts of an insured to defend oneself, one’s property, or defending other parties from harm.

bb. * Agritainment (04 16 addition)

There is no coverage

for bodily injury or property damage related to agritainment – a term that is

defined in the Definitions Section. This exclusion is far reaching and applies

if the injury is directly or is indirectly related to the agritainment. One

example provided is that agritainment acts or omissions that involve a service,

a promise, a service, or a duty even if only implied are excluded.

Attach FL 05 01–Agritainment – Liability Endorsement if coverage is desired.

Related Article: Agritainment Endorsements

* An exception exists – coverage applies to loss by fire to a location that is rented and/or occupied temporarily by the named insured IF that named insured has the premises owner’s permission to do so. Consult Section II-Limits of Insurance for the separate limit that applies to coverage provided by this exception.

COVERAGE I–PERSONAL AND ADVERTISING INJURY LIABILITY COVERAGE

1. Insuring Agreement

The insurance company pays the sums the insured is legally obligated to pay as damages because of personal injury or advertising injury, but only if the insurance coverage applies. The company has the right and the duty to defend a suit against the insured for damages covered under the policy.

It is important to be aware that an insurance company is not offering a legal defense merely for the benefit of an insured. A company has a separate financial interest to protect. This wording is a reminder that the insurance company is a party distinct from the insured.

|

|

The insurance company also makes the decision as to whether to settle or defend a suit. This is an important distinction because some insureds believe that personal injury allegations may damage their reputations and should be vigorously defended. The insurance company is required to meet the obligations created by the policy. If the insured wants the company to defend, and the company wants to settle, the insured may need to withdraw its request for protection and proceed to defend itself. In such a case, the insurance company will owe nothing if the insured loses.

The most the insurance company pays is described in the Limits of Insurance section. Once the limit is paid, the company has no further responsibility to defend the case. Any additional obligations imposed on the company are described in the Additional Coverage section of the policy.

Any

personal injury offense must be committed during the policy period and must

arise or result from personal activities or the farming operation. An

advertising injury is covered only if the offense was committed during the

policy period.

2. Exclusions

a. This group of exclusions applies to personal injury or advertising injury.

- Knowing Violation of Rights of Another

If the insured personally violates the rights of another, or if the insured directs someone else to violate the rights of another, and the insured knows the rights are being violated, there is no coverage.

|

Example: Fran owns a large farm and she rents out parts of her property and structures to others. She decided that only American-born citizens could become her farmer-tenants. She directs her farm rental manager to pre-screen all applicants and turn down any foreigners. When she is sued for violation of rights, the insurance company denies coverage. |

- Material Published with Knowledge of

Falsity (04 16 change)

If the insured personally publishes, wherever it is published, a known falsehood, or directs someone else to publish it, there is no coverage.

|

Example:

Dan was running for a position on the school board. Dan’s opponent, Mary,

had been married for 12 years and had a 12-year-old son. Because she was

running a values-based campaign, Dan started rumors about her premarital activities and he ended up winning the election. Mary sued

Dan, charging him with putting out false information. Mary had medical proof

of the premature birth. It was discovered that Dan knew his statements were

wrong and that he was just trying to influence votes. The insurance company

denied coverage and defense under Dan’s policy but

Dan held onto his school board seat. |

- Material Published Prior to the Policy

Period (04 16 change)

If the suit being brought is due to material originally published (including utterances) wherever published prior to the policy period, there is no coverage.

|

|

Example: In December, Katie wrote a letter to the editorial section of her local paper. She expressed that, in her opinion, Marilyn was an idiot and should not be allowed to teach in the public schools. In January, Katie addressed the school board and made the same statement. Marilyn sued Katie for those remarks. Katie’s insurance coverage changed to a different insurance company on January 1st. The current company denied coverage because the first publication was in December, even though the precipitating event occurred in January. |

- Criminal

Acts

If the insured commits a criminal act, or directs the commission of a criminal act, and that act triggers a personal or advertising injury, there is no coverage for that injury. However, the insurance company is required to defend until the criminal act has been proven through the legal process.

|

Example: Bill is concerned that his neighbor is using unapproved fertilizer on his property. Since they share water from the same underground source, he wants to make sure. Bill breaks into Mike’s barn, takes pictures of the barrels containing the fertilizer in question, and writes a letter to the editor of the local newspaper, accusing Mike of polluting the water. Mike notifies the police that someone broke into his barn and gives them evidence pointing to Bill and then sues Bill for defamation. The insurance company will defend Bill, pending a legal determination of his guilt or innocence. |

·

Contractual

Liability

Coverage does not apply for personal injury or advertising injury that occurs because of an assumption of liability under a contract or agreement, unless the offense would have been covered in the absence of the contract or agreement.

|

Example: Sally brought a permission slip home from school for a field trip to an art museum. Connie signed it without carefully reading it. A year later, Connie and all the other parents that signed the form are sued. The suit alleges that the students published pictures they took of different art museum works. Part of the agreement that Connie and the other parents signed a year earlier barred such publication. The insurance company denied coverage because of the contractual liability exclusion. |

|

|

- Pollution

There is no coverage for ANY pollution-related loss. This is an absolute exclusion.

- Recording and Distribution of Material In Violation of Law

This exclusion makes the policy inapplicable to personal or advertising injury that is related to the sending out of information that is commonly called spam (essentially unsolicited promotional material). No coverage exists for incidents that are considered illegal under the Telephone Consumer Protection Act, the CAN-SPAM Act, Fair Credit Reporting Act, Fair and Accurate Credit Transaction Act or under any similar law.

- War

This exclusion bars coverage for all losses involving military and similar actions, including civilian protests. The bar to coverage is broad, extending even to losses related to an insured attempting to defend against such incidents.

Note: The wording of this exclusion does conflict with the policy exception that is made for intentional acts of an insured to defend oneself, one’s property, or defending other parties from harm.

- Infringement

of Copyright, Patent, Trademark or Trade Secret (04 16 addition)

Note: There is no

requirement that the named insured, an insured, or even someone acting on

behalf of either does the infringing. All infringement is excluded.

There are two exceptions. This exclusion does not apply:

o

When the

named insured's advertisement infringes on copyright, trade dress, or slogan

o When use of another’s advertising idea in the named insured’s advertisement is considered infringement of intellectual property rights

- Electronic

Chatrooms or Bulletin Boards (04 16 addition)

Personal and advertising injury that arises

out of an electronic chatroom or bulletin board the insured owns, hosts, or

controls is excluded.

Note:

It is important to note that

coverage applies for personal and advertising injury related to posting on

chatrooms and bulletin boards as long as the insured did not control, host, or

own them.

- Unauthorized

Use of Another’s Name or Product (04 16 addition)

The insurance company does not pay for personal and advertising injury that arises when the named insured uses the Internet to try to mislead another’s customers or potential customers. This exclusion applies when the misleading is caused by unauthorized use of the name or product of another party in the named insured's email address, domain, or metatag.

b. This group of exclusions apply only to personal injury

- Business Pursuits

Any offense related to an insured’s business other than farming is not covered. There is one exception. This exclusion does not apply to a part-time business conducted by a member of the household under the age of 21 that has no employees.

|

Example: Marty is 16. He is a freelance writer for the local newspaper. He decides the paper needs livening up, so he is reporting on recent activities he has observed. A few of the people named in his articles sue him. Marty is covered since he is under 21, the business is part-time, and he has no employees. The newspaper should have coverage under its own policy as well. |

- Civic or Public Activities for Pay

Any personal injury claimed to be due to any paid civic or public activity is not covered. This is an important exclusion because rural areas usually need a great deal of assistance and farmers are a vital part of the civic and public life of a community. They often are members of school boards, fire departments, hospital boards, and local government councils. The organization or governmental entity should provide this coverage for the members of those organizations.

|

Example: Graham is on the school board. At a recent meeting, he made some comments about the coaching staff at another district. The head coach at that district filed a lawsuit, alleging that the remarks were cruel and vindictive. Graham’s policy denies coverage. The school board’s policy should cover this activity and respond. |

- Personal Injury To An Insured

Persons who qualify under the policy’s definition of insured are not eligible for coverage should they face claims or suits that seek reimbursement or pay back from another party or to participate with another party’s obligation to pay personal injury damages.

- Agritainment (04 16 addition)

There is no coverage for bodily injury or

property damage related to agritainment – a term that is defined in the

Definitions Section. This exclusion is far reaching and applies if the injury

is directly or indirectly related to the agritrainment. One example provided is

that agritainment acts or omissions that involve a service, a promise, a service,

or a duty even if only implied are excluded.

Attach FL 05 01–Agritainment – Liability Endorsement if coverage is desired.

Related Article: Agritainment Endorsements

c. This group of exclusions applies to advertising injury:

·

Breach Of

Contract

Any damage due to breaking the provisions of a contract is not covered, unless due to an implied contract concerning use of the advertising ideas of others in the named insured’s advertisement.

|

Example: Mark made a great little cat drawing that looked a lot like the cat on Fred’s farm. Fred saw the drawing and mentioned that it would make a nice advertising symbol. Mark was surprised when he saw his drawing being used as a logo in Fred's advertising of his produce. Mark sued Fred for using the drawing without giving him compensation. Fred’s policy will respond, because the instance involves an implied advertising contract. |

- Quality or Performance Of

Goods-Failure to Conform to Statements

Losses involving statements made in advertisements regarding the performance of a product or about the quality of the named insured’s services are not covered.

|

Example: Rhoda advertised that her brown eggs were healthier for the consumer than the white eggs sold by her neighbors. One of her competitors challenged this in a suit. The company denied coverage and defense because of this exclusion. |

- Wrong Quotation Or Description Of

Prices

Any discrepancy due to pricing statements made in an advertisement is not covered.

|

|

Example: Farley distributed advertising for his farm’s baby chicks. By accident, the ad price showed the decimal point in the wrong place and he received quite a few excited telephone calls. He disappointed most of the callers with the correct price but several customers still bought the baby chicks from him. Another farmer sued Farley because the incorrect pricing took business away from him. Farley’s insurance company did not respond to the legal action. |

- Insureds

in Media and Internet Type Businesses (04 16 name change

and coverage change)

An offense committed by an insured that is in

the businesses of advertising, broadcasting, publishing, or telecasting. There

is also no coverage if the insured’s business designs or determines website

content for others, or provides Internet search, access, content, or service.

There is an exception. This exclusion does

not apply to the sections of the definition of personal and advertising injury

that address false arrest, detention or imprisonment, malicious prosecution, or

wrongful eviction, entry, or invasion of private occupancy.

This coverage form explains that placing

frames, borders or links, or advertising on the Internet is not considered

being in the business of advertising, broadcasting, publishing, or telecasting,

even if the placement is provided to others.

|

Example: Susan works for the local television station as a reporter. She lives with her husband on a farm. The named insured on the policy is the farm entity and her husband’s name. She investigates a local store and reports on some unusual activities conducted on the premises. The owner of the store files suit against her and the station. The Farm policy denies coverage because she is in the broadcasting business. |

d. There is no coverage for any loss, cost, or expense related to pollution.

This means that any claim, suit, request, or order that pollutants be monitored, tested, contained, neutralized, or handled in any way is excluded. This coverage does not pay for any personal or advertising offense related to pollution.

COVERAGE J–MEDICAL PAYMENTS COVERAGE

1. Insuring Agreement

The insurance company pays all reasonable medical expenses incurred within three years from the date of an accident for injuries caused as a result of that accident. The injury is covered if the injured person was on the insured premises with permission of an insured.

It is also covered if the injured person is off premises but the injury is from a condition in the insured location or on ways immediately adjoining the location. Another off site covered situation is if a farm employee or residence employee, while working for an insured, causes the injury. Injury to a resident employee is covered off premise but only while performing employment related services for the insured. Animal-related injuries to person that occur off premises are covered only if the damaging animal is owned or being cared for by an insured.

|

Example: Frankie decided he would take a shortcut home. He knew a bull was located somewhere on the neighbor’s property but he was pretty sure it would be in the barn at the time he cut through the property. He was almost off the property when he heard the bull approaching fast. He ran as fast as he could but only got to the fence line before the bull caught up and pitched him over. When he got home, his parents took him to the hospital and sent the bill to the bull's owner. The insurance company for the bull’s owner denied coverage because Frankie did not have permission of the owner to be on the property. |

Of course, in a situation such as the above example, things may not be clear-cut. Different factors could affect the insurer’s obligation such as the age of the trespasser, the level of access to the property, existence of warnings, whether trespassers were frequent, etc.

Reasonable medical expenses include expenses incurred for first aid provided at the time of the accident, medical, surgical, X-ray and dental services, including needed prosthetic devices and any ambulance, hospital, professional nursing and funeral services considered necessary. Neither the injured individual nor the insured are in charge of deciding what is necessary and disputes can arise if extraordinary charges are made that were unnecessary. None of the payments made are made based on the fault of any party.

2. Exclusions

There is no coverage for expenses

resulting from or arising out of bodily injury as follows:

a. Professional Services and Business Pursuits (04 16 change)

Coverage does not apply for any injury related to any professional service. This applies even if the claims are based on the insured being neglectful in supervising, hiring, employing, training, or monitoring those providing such services.

Coverage also does not apply to injury related to a business pursuit.

The only exception is for occurrences to residence employees. This exception applies to both of the above.

b. Location Rented, Owned or Controlled by

Insured

There is no coverage at a location rented, owned, or controlled by the insured when that location is not listed as an insured location on the policy. Coverage does apply in an instance involving an injury to a residence employee and the injury is work-related.

c. Farm Employees or Others Maintaining the

Farm

No coverage applies to farm employees or others hired to work at farm operations at the insured location who are injured. However, persons contributing help as a neighborly exchange or a residence employee are covered.

|

Example: Marty’s barn burned down. The community decided to have a barn raising for him and gathered at the farm for the event. The barn was finished in a day. Just as the last nail was driven, George tripped over a sawhorse and fell on Ben. Both fell and were injured. George is Marty’s hired hand, so there is no medical payments coverage for him. Ben is a neighbor and coverage applies for his injuries. |

|

d. Workers Compensation or Similar Law

There is no coverage for anyone who qualifies for coverage under Workers Compensation or similar laws.

e. Injury to Resident

Coverage does not apply to a member of the household or to anyone who lives on the insured location on a regular basis, unless the injury is to a residence employee.

f. Agritainment (04 16 addition)

There is no coverage for injury related to

agritainment – a term that is defined in the Definitions Section. This

exclusion is far reaching and applies if the injury is directly or is indirectly

related to the agritainment. One example provided is that agritainment acts or

omissions that involve a service, a promise, a service, or a duty even if only

implied are excluded.

Attach FL 05 01–Agritainment – Liability Endorsement if coverage is desired.

g. Coverage H Exclusions

No coverage applies for bodily injury excluded under the Bodily Injury and Property Damage section of this policy.

ADDITIONAL COVERAGES

1. Supplementary Payments–Coverage H and I (04 16 change)

The policy pays for supplementary payments under bodily injury, property damage, personal injury, and advertising injury liability for the following expenses when the insurance company defends a lawsuit brought against the insured:

· Costs incurred by the insurance company

· The cost of required bail bonds due to traffic law violation or other accidents caused by a covered vehicle. The cost is capped at $250.

· The cost of bonds to release attachments. However, the cost of only bond limits up to the available limit of insurance are covered. The cost of excess bond amounts is the insured’s responsibility. The insurance company is not required to furnish these bonds.

· The insured’s expenses for assisting the insurance company are covered only if the assistance is requested by the insurance company. These expenses include the loss of earnings incurred by the insured limited to no more than $250 per day. Costs taxed against the insured due to the lawsuit. These court costs do not include attorney fees or expenses that are taxed by the court against the insured.

|

Example: John can’t believe he is being sued. He is innocent and is going to do everything possible to prove it! He hires an investigator to look into the matter and brings in a surveillance team to monitor the plaintiff. He shows up every day at the insurance company to help with their investigation. Finally, the court rules in favor of John. He then submits his bills to the insurance company for payment. They refuse to pay any of his expenses because his assistance was never requested. |

- Prejudgment interest but once the insurance company makes an offer to settle, no further prejudgment interest will be paid.

- Interest that accumulates on the entire judgment amount. Once the insurance company pays its portion of the judgment, offers to pay, or deposits the amount it owes with the court, it is no longer responsible for the interest that accumulates on any the remaining amount owed, if any. Coverage for all of the above expenses is available in addition to the Limits of Insurance.

A second part of the Supplementary Payments applies to any indemnitee named in a lawsuit. The insurance company defends the indemnitee if the contract between the insured and the indemnitee requires it. However, several other conditions must be met before the company is obligated to extend a defense to another party. The insurance provision of the contract must be related to some portion in the contract, the insurance must apply to the liability assumed in the contract, there must be no conflict between the insured and the indemnitee, and the same counsel must represent both parties. The indemnitee must assist in the defense as requested by the insurance company, in the same manner as any other insured.

If these conditions are met, the indemnitee is defended using Supplementary Payments and these are in addition to the Limits of Insurance. If the conditions are not met, any defense will be treated as within the limits.

2. Damage to Property of Others (04 16 change)

The policy pays up to $1,000 per occurrence for property damage to property belonging to others. The insurance company has the option to pay either the actual cash value of the property or to repair or replace the property with property of similar kind and quality.

Several situations are excluded from this coverage. Property damage caused intentionally by an insured older than 13 years of age and property owned by or rented to an insured, tenant or member of the insured's household is not covered. Property damage losses arising out of professional services, agritainment or a business, in connection with other premises or ownership, maintenance, use or loading and unloading of motor vehicles, motorized bikes and tricycles, farm machinery or equipment or aircraft and watercraft are also not covered.

COVERAGE EXTENSIONS–COVERAGES H, I AND J (04 16 change)

The words you and your mean the named insured. With this extension, a spouse who is a resident in the named insured's household is also a named insured. This extension applies to any endorsement attached to the policy.

SECTION II–LIMITS OF INSURANCE

The Limits of Insurance shown in the declarations represent the most the insurance company pays, regardless of the number of insureds, claims brought, or persons or organizations bringing suit.

The General Aggregate Limit is the most the policy pays in any 12-month period for all coverages combined.

The occurrence limit is the most the policy pays for any single occurrence, regardless of the number of persons involved. This limit applies to Coverages H and J. The concept of occurrence includes multiple exposures to the same harmful situation or circumstances.

|

|

Example: Pam was moving her bees from one orchard to another when the tractor she was using to haul the trailer suddenly jerked. The trailer lurched and overturned the hives. The queen bee led a swarm to the nearby elementary school and surrounding homes! Numerous children received multiple stings over a 30-minute period. The children were evacuated and many were hospitalized. For three days after the accident, other children were stung as remaining bees were removed. Pam’s policy treats all stings suffered as a single occurrence, even though the stings occurred at different times, by different bees and even on different days! |

A statement is made that when an insured is held to be vicariously responsible for the actions of a child or a minor, this policy pays only $10,000 on an occurrence basis. It also states that no limit at all is paid if the vicarious liability is due to actions excluded under the Aircraft, Motor Vehicle, Motorized Bicycle, or Tricycle Exclusion or under the Watercraft Exclusion.

|

Example: Jimmy begged his parents for months for a pellet gun. His mother was against the idea, but his father thought he should have one to learn to use it properly. Dad agreed to work with him and only let Jimmy shoot when he could supervise things, so Jimmy got the pellet gun for Christmas. Two weeks later, while Dad was out checking fences and Mom was cooking, Jimmy took out his gun and engaged in some target practice. He got bored with the stationary targets and started shooting at other objects. According to the neighbors, the other things amounted to about $12,000 in damages. Because Jimmy was just nine years old, his father was held vicariously responsible. The insurance company paid $10,000, Dad paid the rest and Jimmy’s pellet gun was sold. Jimmy’s actions are intentional so any suit against Jimmy is excluded. However, Dad is covered because he is vicariously responsible. The policy limits that vicarious responsibility to only $10,000. |

A separate limit for each occurrence is included in the farm liability policy for fire-related property damage at another premises that is rented to the named insured. The same limit applies to premises that are occupied by the named insured with the permission of the owner but only on a temporary basis. This is the separate limit mentioned at the end of the Coverage H exclusions. It is subject to the first paragraph of the overall occurrence limit above.

Subject to the overall general aggregate limit paragraph above, the stated limits for Personal and Advertising Injury is the maximum amount available to pay for the sum of all personal injury plus all advertising injury that is sustained by any single entity.

The Medical Expense protection is capped by the limit shown on the declarations. It is the most available for any one person. It is subject to the overall occurrence limit above.

The last part of this section reminds the insured that the limits are for a 12-month period. When the policy is renewed, the policy aggregate limit is fully refreshed and starts over. If the policy period is less than 12 months, the aggregate is the full limit, not a pro-rated amount. If a policy is extended by endorsement beyond the 12-month term, the 12-month aggregate is not replenished during the period of the extension.

|

Example: Jean is changing the policy period on her policy. She asks her agent whether she should extend her current policy or renew for a short term and then have a full year on the new policy. The answer is the more policy periods there are, the better because the aggregate limits are refreshed for each policy period. If she has an aggregate limit of $500,000, her policy period is 1/1-1/1, and she extends to 3/1, she has $500,000 for 14 months. If she takes the short-term policy, she has $500,000 for the period 1/1-1/1. She then has another $500,000 aggregate for the period 1/1- 3/1. The insurance company charges the same premium regardless of which option is chosen, so the better bargain and maximum protection is by taking the short-term policy instead of the 14-month extension. |

SECTION III–FARM LIABILITY CONDITIONS

Loss Conditions

1. Bankruptcy

Even if the insured becomes insolvent, the insurance company is required to respond as though no bankruptcy occurred.

2. Duties in the Event of Occurrence, Offense,

Claim or Suit

The named insured has a number of requirements to be completed in order for a claim to be paid. The claim may be denied if they are not completed AND that failure harms (prejudices) the insurance company’s rights. The responsibilities are:

·

The named

insured must tell the company, as soon as practicable (as opposed to possible)

about a situation that could result in a claim. The claim notice must include

information about how, when, where, who and any witnesses to the event. A

complete description of the incident is required. This information is important

because the sooner the company can react to a situation, the more likely it is

that a positive settlement can be made for all parties involved. Stories tend

to change as time goes by.

·

Once a claim

or suit is brought against any insured, the details concerning the notice must

be recorded. The insurance company should then be notified as soon as

practicable. Written notice of the suit or claim should then follow, also as

soon as practicable.

·

The named

insured, and any other insured involved in a loss, must notify the police or

the appropriate law enforcement agency but only if a crime has taken place. The

insured must immediately send copies of all legal papers to the insurance

company. These documents usually have time constraints, so timeliness is

essential. Finally, the insured must provide authorization to the insurance

company to obtain records and also must cooperate and assist the company in

enforcing all applicable rights.

Note: If the named insured does not want to get the

police involved and/or doesn’t want to help in enforcing its rights, the

insurance company is not required to provide coverage.

·

No insured

may assume any obligations, unless they decide to pay for them on their own.

The only exception is any first aid provided at the time of the incident.

·

Any injured

person asking for medical payments coverage under Coverage J. is required to

comply with several requirements. They must provide written proof of the loss,

permit the insurance company to obtain medical records and submit to physical

examination by a physician selected by the insurance company.

·

If the claim

is for Additional Coverage–Damage to Property of Others, a signed and sworn

proof of loss, along with any damaged property still in the insured’s control,

must be given to the insurance company within 60 days after the date of loss.

|

Example: Cindy was swinging from the hayloft in Doug’s barn. She fell flat on her back and had the breath knocked out of her. Doug called for an ambulance that took Cindy to the hospital. She was released to go home after a few hours. Doug checked with her and found that everything was fine. Doug thought nothing more of it until three months later when he received legal papers. He immediately contacted his insurance agent who advised him that all information should be forwarded to the insurance company promptly. He attempted to reconstruct the situation in his mind. The insurance company informed him they were proceeding with the defense under a reservation of rights because Doug did not notify them about the incident sooner. |

|

3. Insurance

Under Two or More Coverages

If two or more coverages in the policy apply to the same loss, the policy does not pay more than once. Indemnity policies only pay up to the actual loss amount.

|

Example: Tiffany was a residence employee at the Kelly farm. She was injured during a barn fire. The insurance company paid all of her medical bills under Coverage J–Medical Expense. She then sued for damages. In her lawsuit, she claimed both the medical bills and other damages. Because the medical expenses had already been paid, the insurance company only responded for the additional damages. |

4. Legal

Action Against Us

This coverage is being provided on behalf of the named insured so the insurance company cannot be joined in any suit that involves any insured.

The insurance company can be sued but only after all conditions and terms of the coverage form have been met.

This provision also states that when the insurance company is sued, the policy’s limit remains the maximum that is available and that the coverage form terms and conditions dictate about what circumstances the insurance company is responsible to pay.

5. No

Admission of Liability with Medical Payments

Payment of medical expenses does not admit guilt

or liability on the part of any insured. This is a common and necessary policy

provision. Medical expenses must be handled quickly to be certain the injured

party obtains proper medical care. This humane coverage element could be

jeopardized if an injured party could use a medical payment to represent an

admission of fault.

Related Court Case: Admission of Liability Negates Insurer's Obligations

6. Other

Insurance

This insurance pays in

proportion to other insurance in place at the time of loss. The only exception

is coverage that might be available for a loss involving motor vehicles, mobile

equipment on owned premises or watercraft. When other insurance is available to

cover a motor vehicle, mobile equipment, or watercraft that is also covered

under this policy, the coverage under this policy will not apply as long as

that other coverage is available.

Note: This provision means that the

purchase of vehicle, mobile equipment, or watercraft specific coverage may

apply in excess of the other coverage.

|

Example: Scenario 1: Kelly has a number of boats and purchases a special watercraft policy that includes both physical damage and liability coverage to insure them. Kelly was boating on a lake on his property when an accident occurred and two people were injured. He notified both the watercraft policy insurance carrier and his farm liability insurance company. The farm liability carrier denied all coverage because of policy exclusions. Scenario 2: Same situation except an accident occurs on Kelly’s Farm when three children were playing on the boats. The boats were stored on dry land and the children fell off of the boats resulting in serious injury. The watercraft carrier is primary and this policy will respond only on an excess basis. |

7. Transfer

of Rights of Recovery Against Others to Us

The insured must transfer all rights to recover from a third party to the insurance company. The insured must also agree to help the insurance company exercise those rights through even a lawsuit if necessary. However, the rights apply only to the amount of the loss that the insurance company paid.

|

Example: Fred, Sam, and George were at Greg’s farm and working together staking tobacco. Their plan was to help each other complete the tobacco crop since they all had their own crops to bring in. Sam drove, Greg did the cutting, George was staking and Fred was on the back of the trailer picking up the stakes. Sam was bored and started goofing off. He tossed Fred off the back of the truck and right on a tobacco stake. The injury occurred on Greg’s farm, so he took responsibility, got Fred to the hospital, and notified his insurance company. The company acted responsibly, paid the hospital and medical bills, and then informed Greg that they were going to assume Greg’s rights of recovery against Sam for his contribution to the loss. |

|

Additional Conditions

1. Liberalization

Any positive change in policy coverage made by the insurance company without a premium charge is automatically made a part of this coverage form, if it occurs within 45 days before commencement of the policy period or during the policy period.

2. Representations

The named insured agrees that all statements in the policy are accurate and based on representations made by the named insured. Finally, the named insured agrees the policy is written based on the insurance company relying on these statement and representations.

3. Separation

of Insureds

All insureds named in the policy are treated equally except for specific responsibilities assigned to the first named insured. All insureds are also treated equally when claims or suits are brought against them. However, the Limits of Insurance are cumulative for all insureds.

|

Example: Kevin is an employee of Hernandez. Recently, both were sued for alleged negligent actions at the farm. The insurance company will represent both of them. The policy limit is $500,000 per occurrence. There are two insureds in the action but this does not mean limits of $500,000 plus $500,000. Even though the action involves multiple insureds, the policy limit is only $500,000 in any one occurrence. |

SECTION IV–DEFINITIONS

1. Advertisement (04 16 change)

Any public notice

involving the named insured’s farm-related products (as well as its goods or

services) published for the purpose of gaining business. Internet placed information is also considered advertisement including

the part of the named insured’s website designed to attract customers or

supporters. Other parts of the website are not considered advertisement.

2. Advertising Injury (04 16 change)

Any injury that takes place due to any of the following:

·

Slander or

libel regarding an organization, person, or anything associated with the

products or services of that person or organization. This applies regardless of the manner in which the information is communicated.

·

Violation of

any rights of privacy through an oral or a written publication. This applies regardless of the manner in

which the information is communicated.

·

Using

someone else’s idea in the named insured’s advertisement.

·

Infringing

on the copyrights, slogans, etc., of others when advertising.

3. Agritainment (04 16 addition)

Any activity that meets all of the following criteria: